Declaration Reporting

A declaration report can be generated from the Find Declaration results list. For a guide to general searching and reporting within Sequoia, please click here.

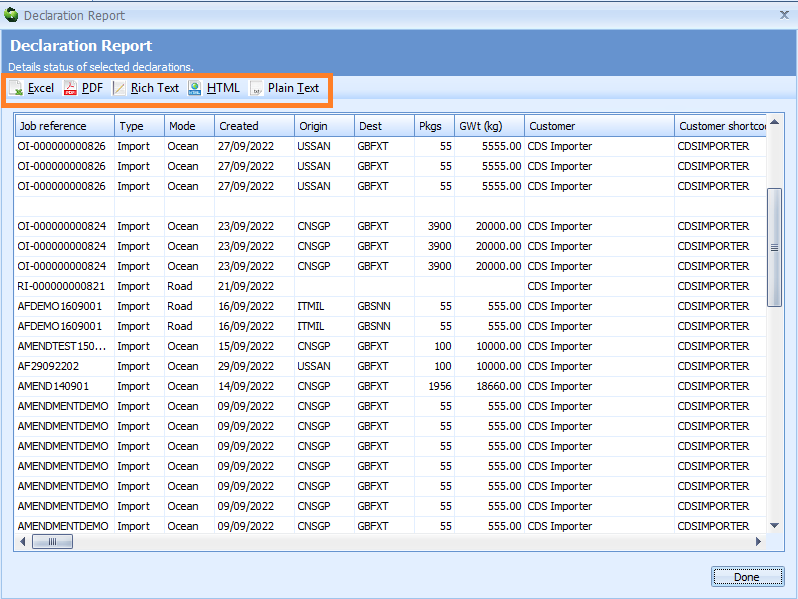

The report is for every declaration displayed in the search results grid and is at declaration item level (ie, one row for every item of every declaration).

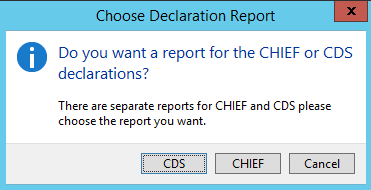

The report output is different to the existing declaration report for CHIEF declarations and a mix of CHIEF and CDS declarations cannot be displayed in the same report. The columns included in the report are detailed in the report structure section below.

In a change to the existing declaration report for CHIEF declarations, a progress bar is displayed to give a visual guide as to how long the report will take to be generated.

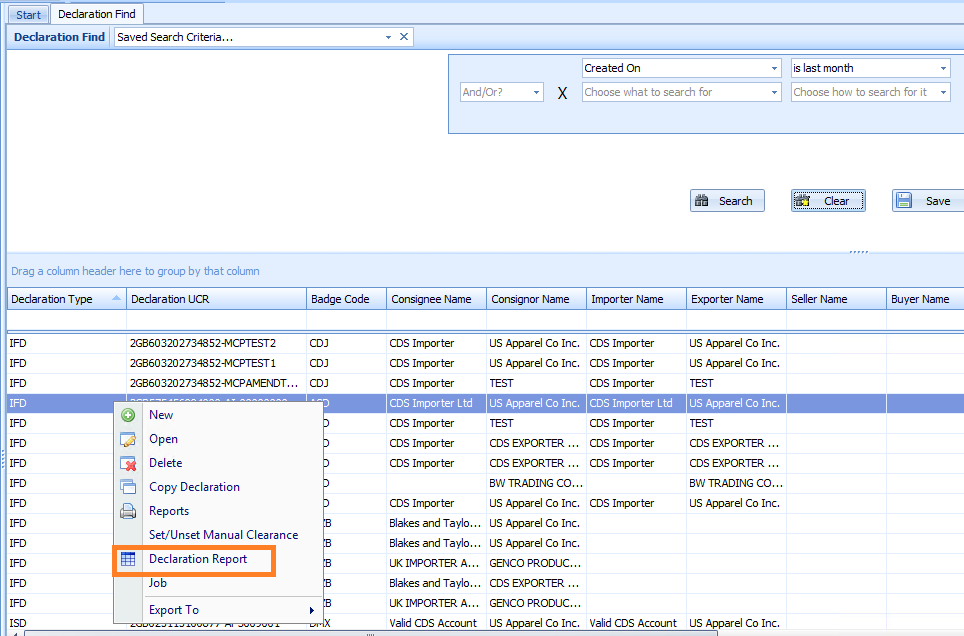

How to generate the report

Right-click the search results grid and choose the Declaration Report option.

If your search results contain both CHIEF and CDS declarations, you will be prompted to choose which type of declaration you would like the report based on.

The report can be output to your preferred file type by clicking one of the buttons on the report dialog toolbar.

Report Structure

The report columns and any relevant data descriptions are noted below.

| Column Caption | Notes |

|---|---|

| Job reference | |

| Type | "Import" or "Export" |

| Mode | Air, Road or Ocean - Derived from job type |

| Created | Job creation date (dd/MM/yyyy) |

| Origin | Job origin (UN/LOCODE) |

| Dest | Job destination (UN/LOCODE) |

| Pkgs | Job packages |

| GWt (kg) | Job gross weight |

| Customer | Job customer name |

| Customer shortcode | Job customer shortcode |

| Shipper | Job consignor name |

| Shipper shortcode | Job consignor shortcode |

| Consignee | Job consignee name |

| Consignee shortcode | Job consignee shortcode |

| Master | Shipment master / air inventory prefix + master (125-12345678) |

| House | Shipment / air inventory house |

| SRF | air inventory split reference |

| Entry type | IFD for Full Declaration ISD for Supplementary Declaration SFD for Simplified Declaration ICR for C21 Declaration (COJ COK, IMJ or IMK Decln Type [01]) EIDR for C21 EIDR Declaration |

| LRN | |

| MRN | |

| Acceptance dtm | Date and time when the declaration was accepted/lodged in the format dd/MM/yyyy HH:mm |

| Taxpoint Date | Mapped from the Acceptance Date in the declaration |

| Decln type [01] | |

| Trader ref [07] | |

| Exporter EORI [02] | |

| Exporter name [02] | |

| Exporter shortcode [02] | |

| Importer EORI [08] | |

| Importer name [08] | |

| Importer shortcode [02] | |

| Declarant EORI [14] | |

| Declarant name [14] | |

| Declarant shortcode [14] | |

| Representative | Included in the output from Release 5.47 |

| Representative shortcode | Included in the output from Release 5.47 |

| Declt repr [14] | Repr Status [14] |

| Disp Cntry [15a] | |

| Dest Cntry [17a] | |

| Inv curr [22] | |

| Inv total [22] | |

| Inv exch rate | Mapped from the declaration if declared, otherwise the rate of exchange at the time of declaration acceptance where currency is not GBP |

| Transport Type [18] | Arrival Transport Type [18] |

| Transport ID [18] | Arrival Transport ID [18] |

| Trpt mode [25] | |

| Inld trpt mode [26] | |

| Goods location [44] | |

| Exit office [29] | Will be used for export declarations |

| DUCR [44] | Header level Previous Document [40] reference where Type = DCR |

| DUCR part [44] | Header level Previous Document [40] reference where Type = DCS |

| Master UCR | Header level Previous Document [40] reference where Type = MCR |

| Warehouse ID | |

| Containers [31] | All header level Containers - each wrapped in square brackets and comma separated. |

| 1st DAN [48] | 1st Deferment number |

| 2nd DAN [48] | 2nd Deferment number |

| Loading airport [61] | |

| Air trpt costs [62] | |

| Frt chgs curr [63] | |

| Frt chgs [63] | |

| Frt chgs exch rate | If currency is other than GBP then the rate of exchange at the time of declaration acceptance |

| Frt apportionment [64] | |

| Discount curr [65] | |

| Discount amt [65] | |

| Discount exch rate | If currency is other than GBP then the rate of exchange at the time of declaration acceptance |

| Discount percent [65] | |

| Insurance curr [66] | |

| Insurance amt [66] | |

| Insurance exch rate | If currency is other than GBP then the rate of exchange at the time of declaration acceptance |

| Other curr [67] | |

| Other amt [67] | |

| Other exch rate | If currency is other than GBP then the rate of exchange at the time of declaration acceptance |

| VAT adjt curr | |

| VAT adjt amt | |

| VAT adjt exch rate | If currency is other than GBP then the rate of exchange at the time of declaration acceptance |

| Other additions/deductions | Any other header level Other Additions / Deductions (ie those in the grid) - each wrapped in square brackets and comma separated - if Currency is not GBP then show the rate of exchange at the time of declaration acceptance - for example [AB GBP 555.66], [AE USD 150.00 @ 1.4214] |

| Tot cstms value | From the latest DMSTAX: Sum of all item level AdValoremTaxBaseAmount where the DutyTaxFee/TypeCode begins with 'A' |

| Tot VAT value | From the latest DMSTAX: Sum of all item level AdValoremTaxBaseAmount where the DutyTaxFee/TypeCode begins with 'B' |

| Tot duty | From the latest DMSTAX: Sum of all item level TaxAssessedAmount where the DutyTaxFee/TypeCode begins with 'A' |

| Tot VAT | From the latest DMSTAX: Sum of all item level TaxAssessedAmount where the DutyTaxFee/TypeCode begins with 'B' |

| Tot Other | From the latest DMSTAX: Difference between header TaxAssessedAmount and sum of Tot Duty + Tot VAT columns |

| Tot Duty Paid | From the latest DMSTAX: Sum of all item level PaymentAmount where the DutyTaxFee/TypeCode begins with 'A' |

| Tot VAT Paid | From the latest DMSTAX: Sum of all item level PaymentAmount where the DutyTaxFee/TypeCode begins with 'B' |

| Tot other Paid | From the latest DMSTAX: Difference between header PaymentAmount and sum of Tot Duty Paid + Tot VAT Paid columns |

| Item no | |

| Comm code [33] | |

| Add comm code [33] | 1st additional commodity code |

| Add comm codes [33] | Any other additional commodity codes - wrapped in square brackets and comma separated |

| Description [31] | Goods Description [31] |

| Pref [36] | |

| Orig cntry [34a] | |

| Cntry of Pref Origin [34b] | |

| Procedure [37] | Combination of Procedure Code [37] and 1st additional Procedure Code |

| Add proc codes [37] | Any other additional procedure codes - wrapped in square brackets and comma separated |

| Net mass [38] | |

| Quota [39] | |

| Item price [42] | |

| Third qty [44] | |

| Previous documents [40] | All item level Previous Documents - each document wrapped in square brackets and comma separated. Format: [Category-Type-Reference] |

| AI Statements [44] | All item level AI statements - each wrapped in square brackets and comma separated. Format: [Code Description] |

| Documents [44] | All item level Documents, Certificates - each wrapped in square brackets and comma separated. Format: [Type Status Reference] |

| Containers [31] | All item level Containers - each wrapped in square brackets and comma separated. |

| Stat value [46] | |

| Item customs value | From the latest DMSTAX: Item level AdValoremTaxBaseAmount where the DutyTaxFee/TypeCode begins with 'A' |

| Item Value for VAT | From the latest DMSTAX: Item level AdValoremTaxBaseAmount where the DutyTaxFee/TypeCode begins with 'B' |

| Item Duty | From the latest DMSTAX: Item level TaxAssessedAmount where the DutyTaxFee/TypeCode begins with 'A' |

| Item Duty rate | From the latest DMSTAX: Item level DutyTaxFee/TaxRateNumeric where the DutyTaxFee/TypeCode begins with 'A' Value to 2 decimal places - show 0.00 if no duty payable |

| Item VAT | From the latest DMSTAX: Item level TaxAssessedAmount where the DutyTaxFee/TypeCode begins with 'B' |

| Item VAT rate | From the latest DMSTAX: Item level DutyTaxFee/TaxRateNumeric where the DutyTaxFee/TypeCode begins with 'B' Value to 2 decimal places - show 0.00 if no VAT payable |

| Item Other rev | From the latest DMSTAX: Item level TaxAssessedAmount where the DutyTaxFee/TypeCode does not begin with 'A' or 'B' - Will not include any DutyTaxFee/TypeCode where the description begins with "Security" - For example, would not include the TaxAssessedAmount for a DutyTaxFee/TypeCode of IPR as the description is "Security - Inward Processing Relief" From release 5.39 of Sequoia, any duty revenue which does not have a Tax Type of A00 (anti-dumping duty, for example) will be included in this column |

| Item Dispatch Country [15a] | |

| Item Destination Country [17a] | |

| Supplementary Units [41] | |

| Modified By | Name of the last user to modify the declaration |

| Modified Date | |

| Created By | Name of the user who created the declaration |

| Creation Date | Declaration creation date/time (dd/MM/yyyy HH:mm) |

| Status | Declaration status |