Job Costing and Invoicing

Costing Export Consolidations, Shipments and Import ETSF Consignments

You can add costs and sales to an export shipment or consolidation or an ETSF consignment in exactly the same way as you do to cost jobs in Sequoia. You can raise invoices and credit notes in the same way.

To access the Job Costing form on an export consolidation, shipment or ETSF consignment, click on the Open Job Costing button on the toolbar at the top of the form.

Apportioning Costs Across Jobs

You can also apportion costs across all of the jobs associated to it. This is so that the total amount you are expecting to be billed appears when the purchase invoice is received and you don’t have to work out the apportionment manually and add a charge line against each job.

Note that you can only apportion costs from an export consolidation or shipment once you have finalised it.

To apportion once you have recorded an expected cost, right click on the charge line on the list and select Apportion Cost from the menu.

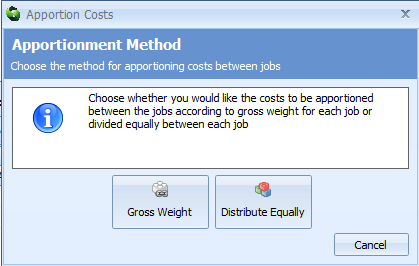

A dialog will display (as shown below) asking you to confirm how you would like to apportion the cost.

You can select to apportion by Gross Weight, Chargeable weight or to spread the cost equally between all the jobs. Click the button which reflects your choice and the dialog will close.

Note that the Accrual Status column for that charge line will now display a

icon to indicate that it has been apportioned.

If you have apportioned an expected cost across multiple jobs then:

- It is only the total accrual on the consolidation that will be available to reconcile against a purchase invoice

- The total accrual on the consolidation will not be considered as part of any profit and loss calculation.

- The total accrual on the consolidation will be spread over all of the jobs associated to it. The sum of all those apportioned accruals will always match the total exactly. If it cannot be divided exactly then one of the apportioned accruals will be rounded accordingly.