Job Costing and Invoicing

Calculating Profit and Loss

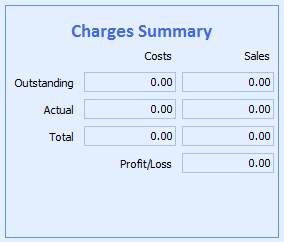

The charges summary panel (see below) on the job costing form summarises the profit or loss against the job or consolidation etc. to which it relates.

The panel shows the following:

| Label | Value |

|---|---|

| Outstanding Costs | The sum of the expected costs that have not been reconciled to a purchase invoice. |

| Actual Costs | The sum of the actual costs that have been reconciled to a purchase invoice. |

| Outstanding Sales | The sum of the sales that have not yet been included on a sales invoice. |

| Actual Sales | The sum of the sales that have been included on a sales invoice. |

| Profit/Loss* | The difference between all of the sales and all of the costs – but see the note below. A negative number (i.e. with a minus sign to the left of it) denotes a loss. |

Note that the figure calculated as profit or loss can be affected by the charge code records set up in Sequoia.

By default, the costs and sales entered for a particular charge code are included in the profit/loss calculation.

However, it is possible to configure a charge code so that any costs and sales entered against it are excluded from this calculation – see Creating Charge Codes for more information. If that is the case then, although the values related to that charge are included in the sales and cost figures, the difference between them is not included in the profit/loss calculation.