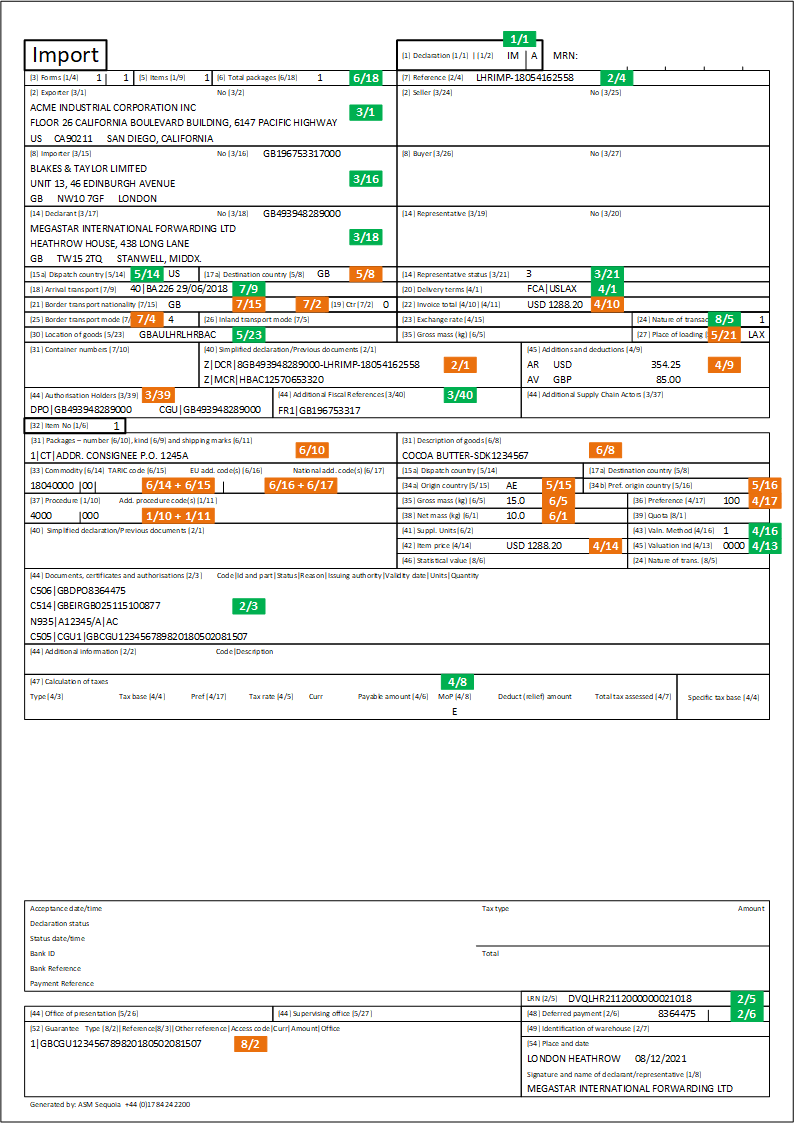

Example import home use declaration

This page steps through an example of an import declaration to home use (procedure code 40 00).

The image below is an example declaration report, with the significant data elements highlighted. Each of these highlighted data elements is discussed in the sections below, including details of where to input the information into the Sequoia CDS declaration forms.

Where the data element numbers in the below example have a  background, it indicates that the information in those boxes can be completed automatically.

Where that is the case, details of how to make that happen are also described in the sections below.

background, it indicates that the information in those boxes can be completed automatically.

Where that is the case, details of how to make that happen are also described in the sections below.

This is an example only. You should not assume that all such declarations are completed in exactly the same way. You should always read the guidance before submitting a declaration.

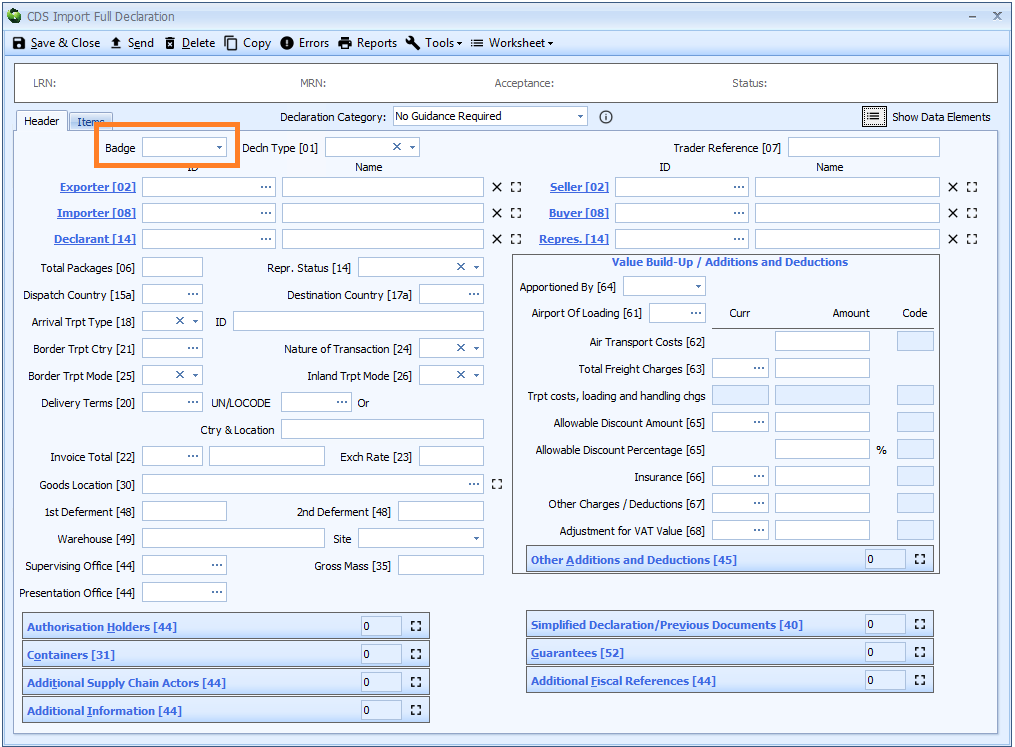

Badge

Whilst the badge code isn't transmitted to customs as part of the declaration, it is required in Sequoia as it is used as the first part of the Local Reference Number (LRN). You cannot send a declaration in Sequoia unless you have specified the badge code.

The badge is declared on the header tab of the declaration form.

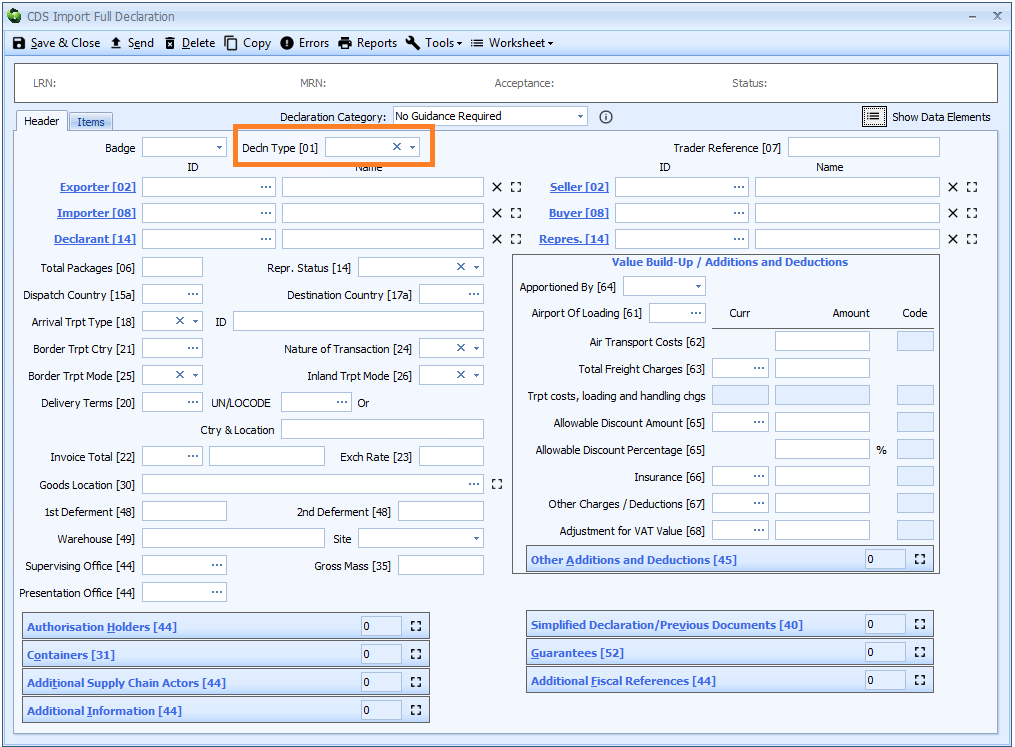

[1/1] Declaration type (SAD box 01)

Declaration type is mandatory, just like it is in CHIEF. The values haven't fundamentally changed.

Declaration type is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

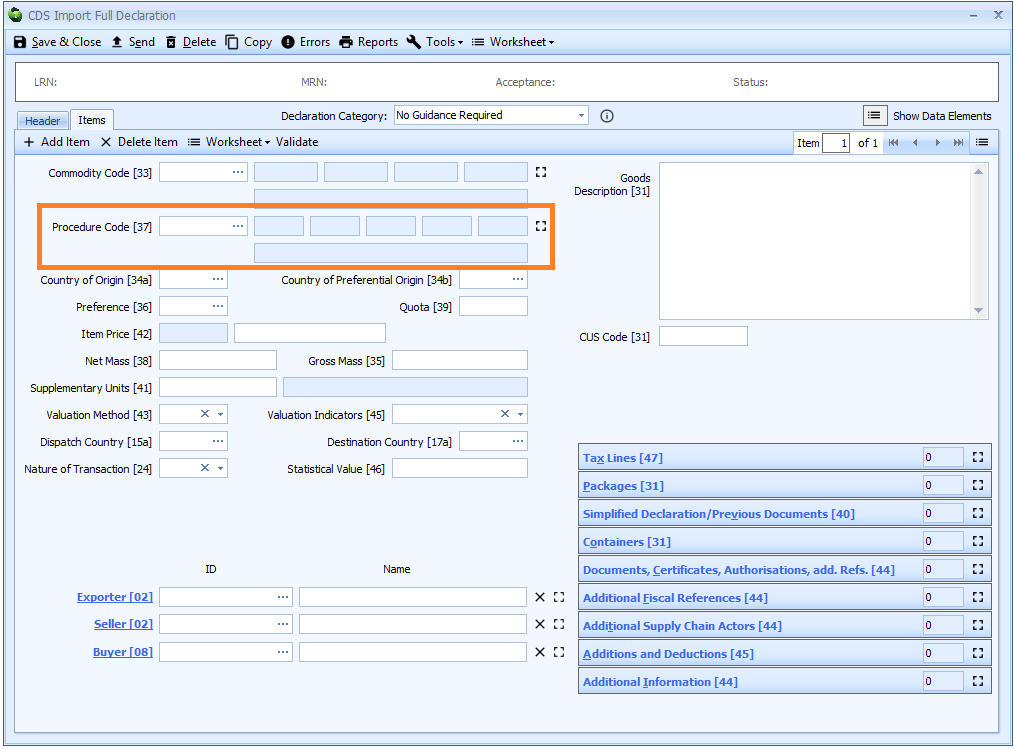

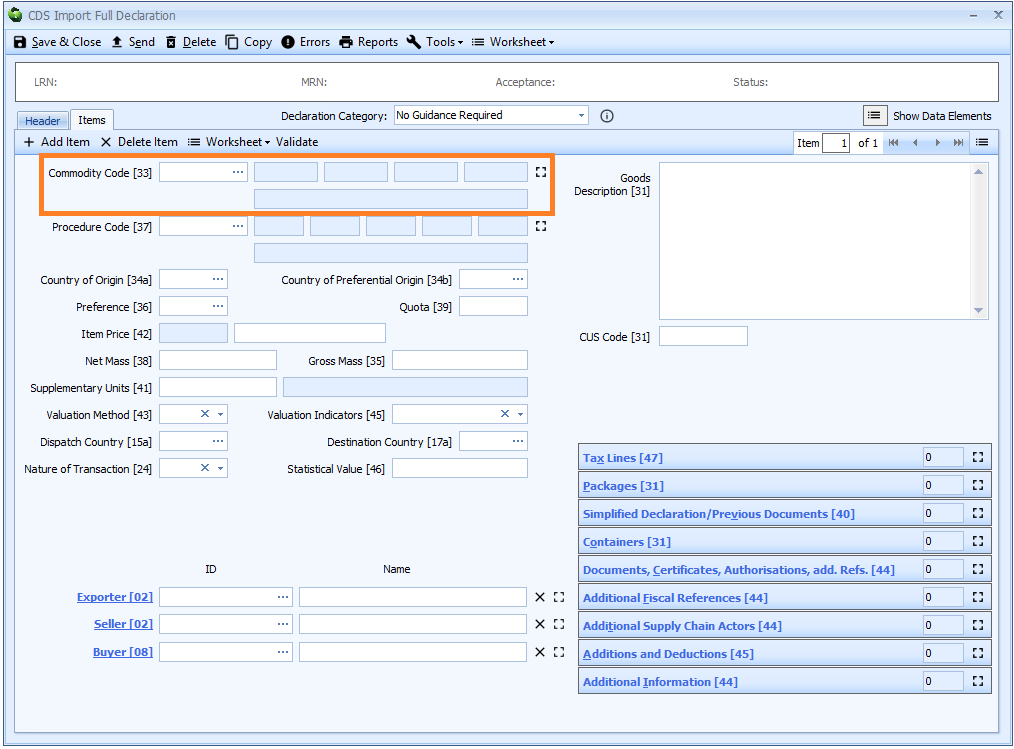

[1/10] Procedure code (SAD box 37)

The procedure code is essentially the first 4 digits of the old CHIEF CPC code.

For a declaration to home use the code is 4000.

The procedure code is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[1/11] Additional procedure code (SAD box 37)

As soon as you enter the procedure code - as above - the first additional procedure code box is enabled (as shown below).

In CDS, if there are any reliefs etc. that are associated with the procedure then they are declared as additional procedure codes. In CHIEF, such reliefs etc. meant that a separate CPC code was required.

For example, if you are claiming relief from duty for goods of negligible value, then you would declare an additional procedure code of

C09.

See [Completing Import CDS Declarations] for more information.

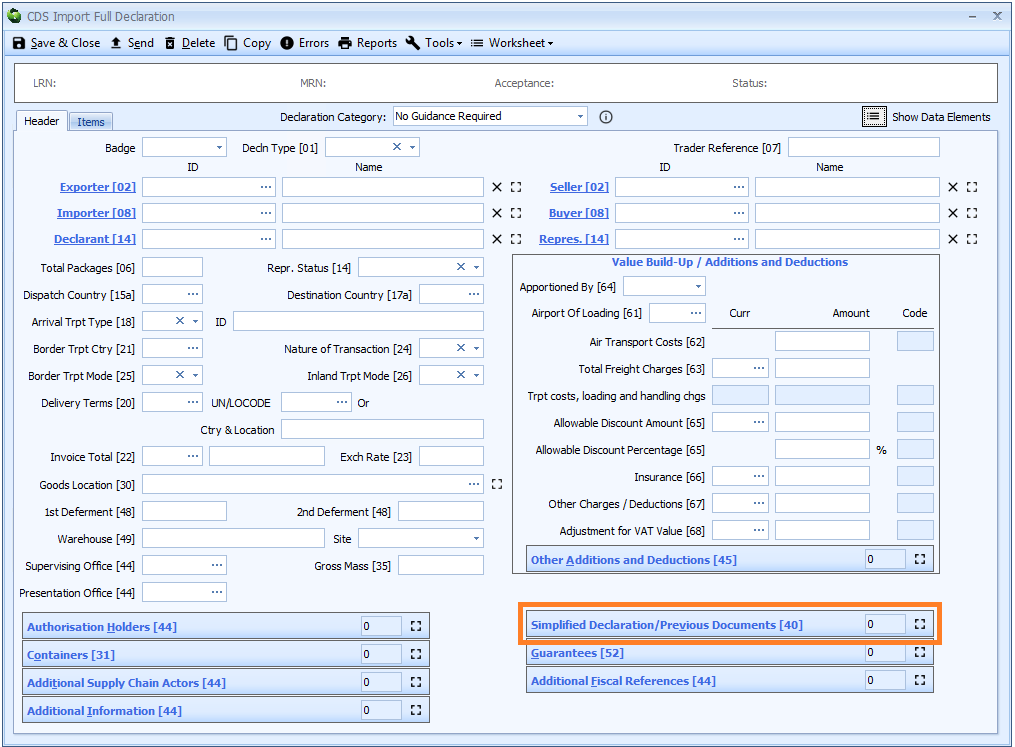

[2/1] Simplified declaration/Previous documents (SAD box 40)

CDS declarations include both the MUCR (code MCR) and DUCR (code DCR) as previous documents (as shown in the example), as well as any associated DUCR part number (code DCS - not shown). CHIEF had these as separate boxes.

Sequoia will automatically generate the DUCR for you once you enter the importer and declarant. If the declaration is created from an inventory-linked job then the MUCR will also be added automatically.

This is exactly the same behaviour as for CHIEF declarations.

Previous documents are typically declared on the header tab of the declaration form but can also be declared on the item tab.

See [Completing Import CDS Declarations] for more information.

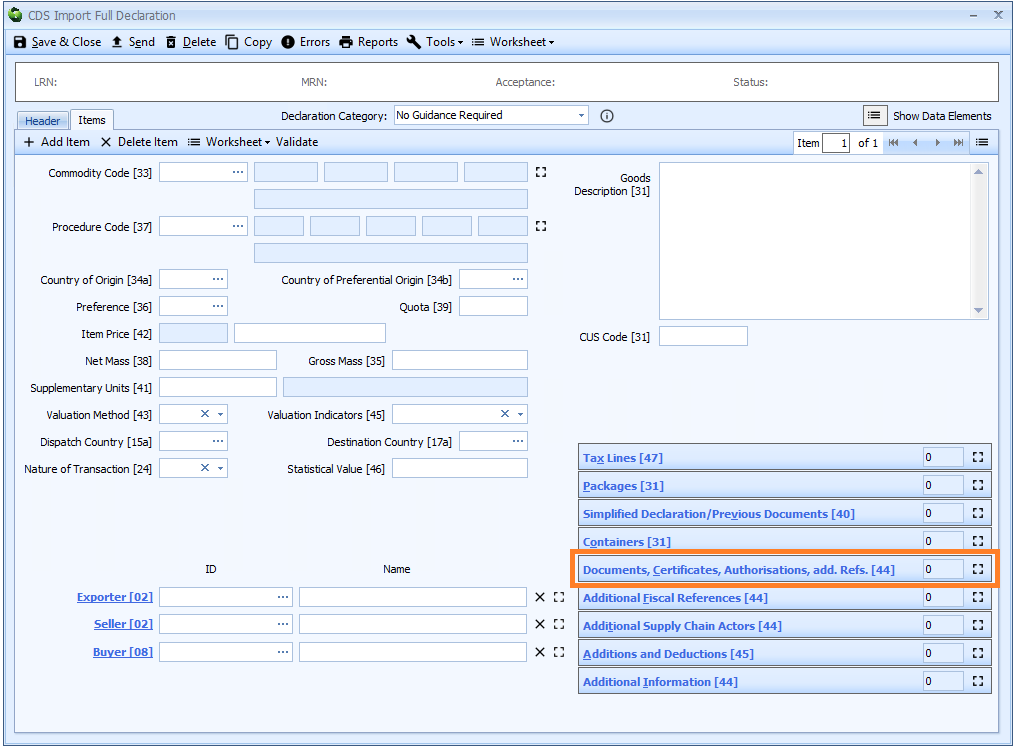

[2/3] Documents, certificates and authorisations (SAD box 44)

There are various document declarations that need to be included, depending on the circumstances.

- Where customs duty is payable, details of the guarantee to cover the debt are required - document code

C505. See [Deferred payment] for details. - Where customs duty is being deferred, details of the deferment account are required - document code

C506. See [Deferred payment] for details.

The above documents should be added automatically, where required. They are only required on the first item.

For a home use import declaration, where the valuation method is 1, a document with code N935 is also required to declare the commercial invoice number(s). This document declaration also requires a status.

This document declaration is only required on the first item.

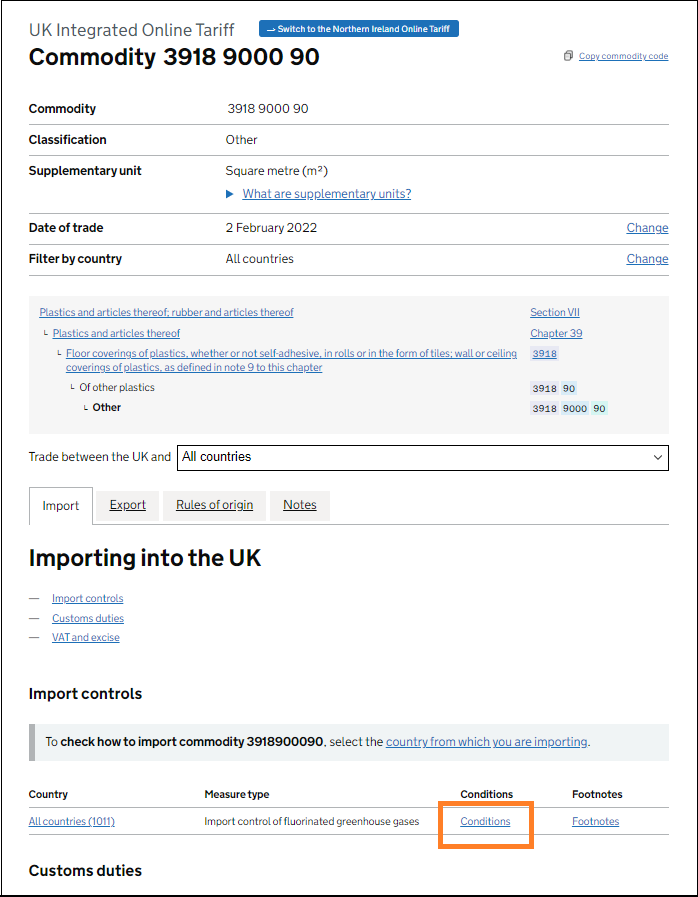

Other documents, certificates and authorisations

There may well be more documents etc. required to be declared for each item, depending on the commodity code declared. You can check the commodity code using the UK Integrated Online Tariff on gov.uk.

Once the details of the commodity code are displayed (as shown in the below example), any documents required will be shown as [Conditions] against an Import Control measure - as highlighted at the bottom of the image.

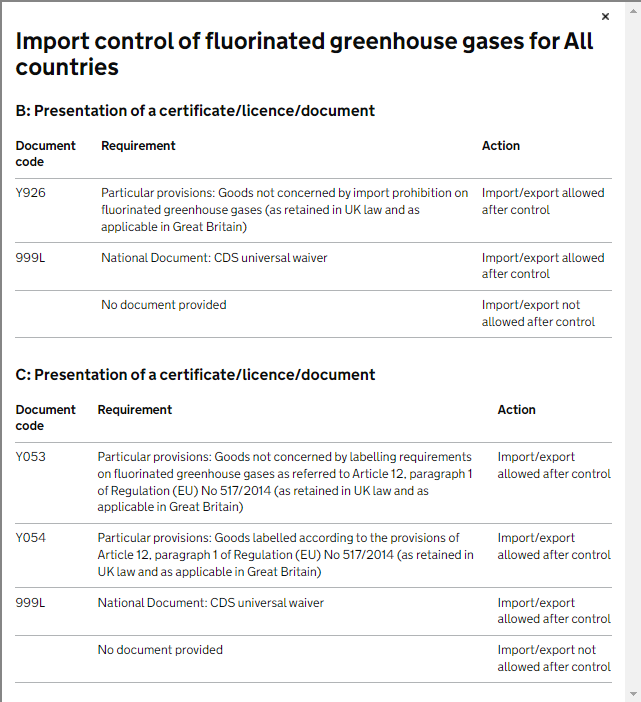

Clicking on [Conditions] will display any document requirements, as illustrated below.

This example has 2 groups of conditions. Each group is satisfied by declaring the appropriate document code from the list.

Where a document declaration is required on all items, you can right click the document in the grid and select [Apply to all items].

Documents are declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

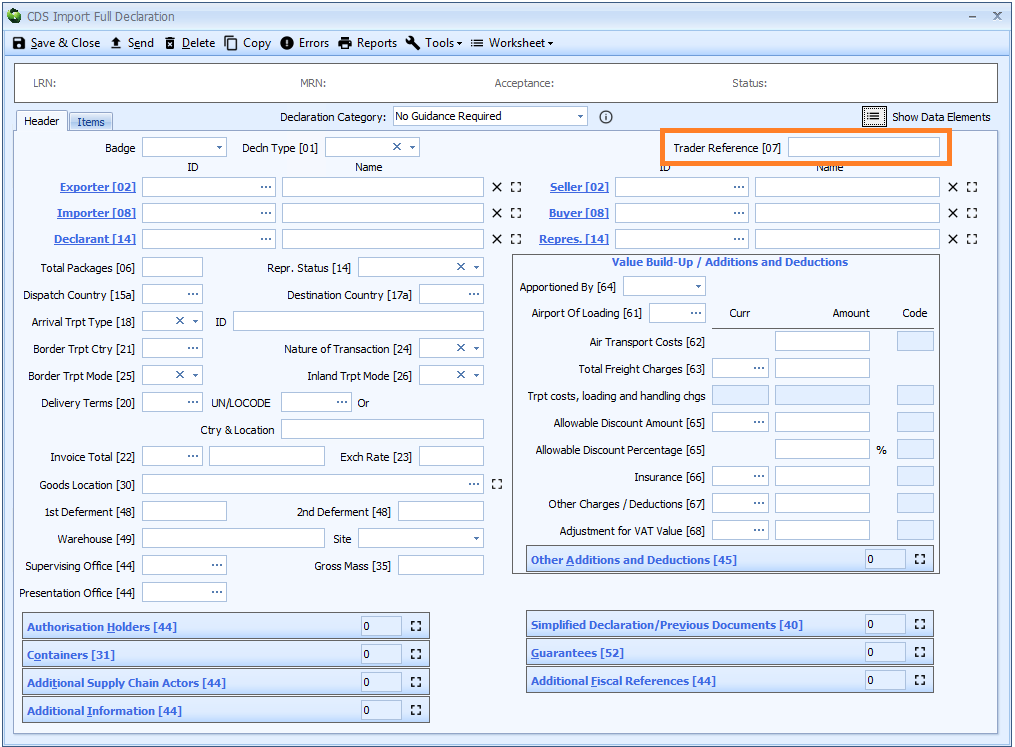

[2/4] Trader reference (SAD box 7)

This reference is optional. However, if entered it will appear on deferment statements etc.

If the declaration is created from a job then this will default to the job reference.

This is exactly the same behaviour as for CHIEF declarations.

The trader reference is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

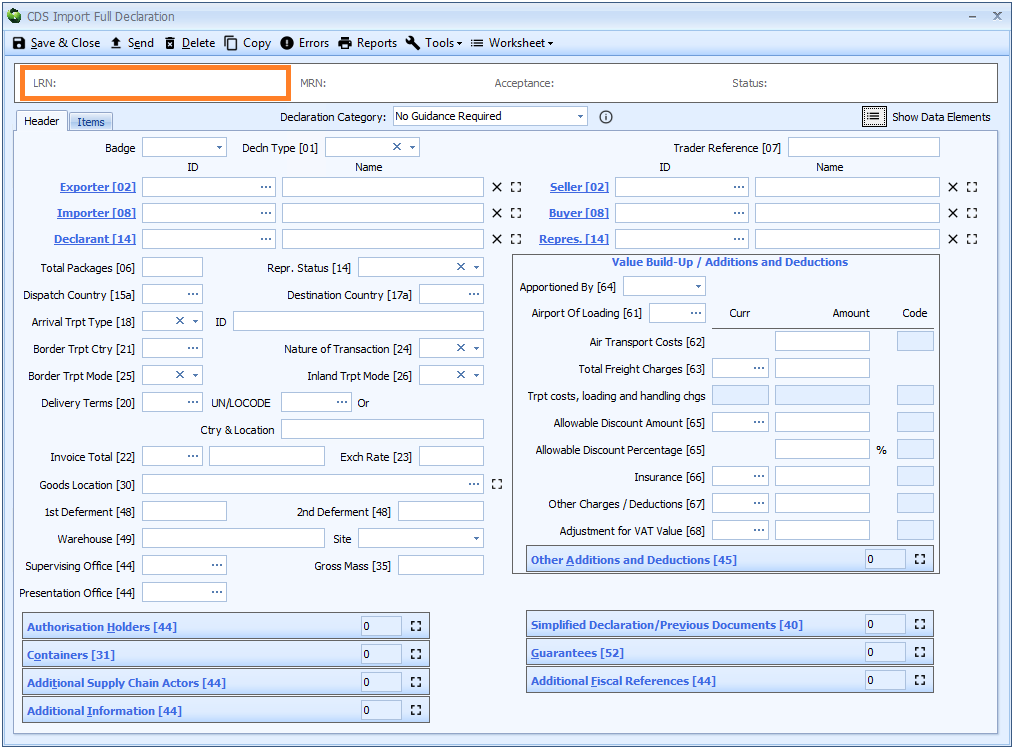

[2/5] LRN

The LRN (Local Reference Number) is mandatory.

Sequoia generates the LRN automatically when you specify the badge and you cannot override this.

The LRN is visible at the top of the declaration form.

See [here] for details of how the LRN is generated by Sequoia.

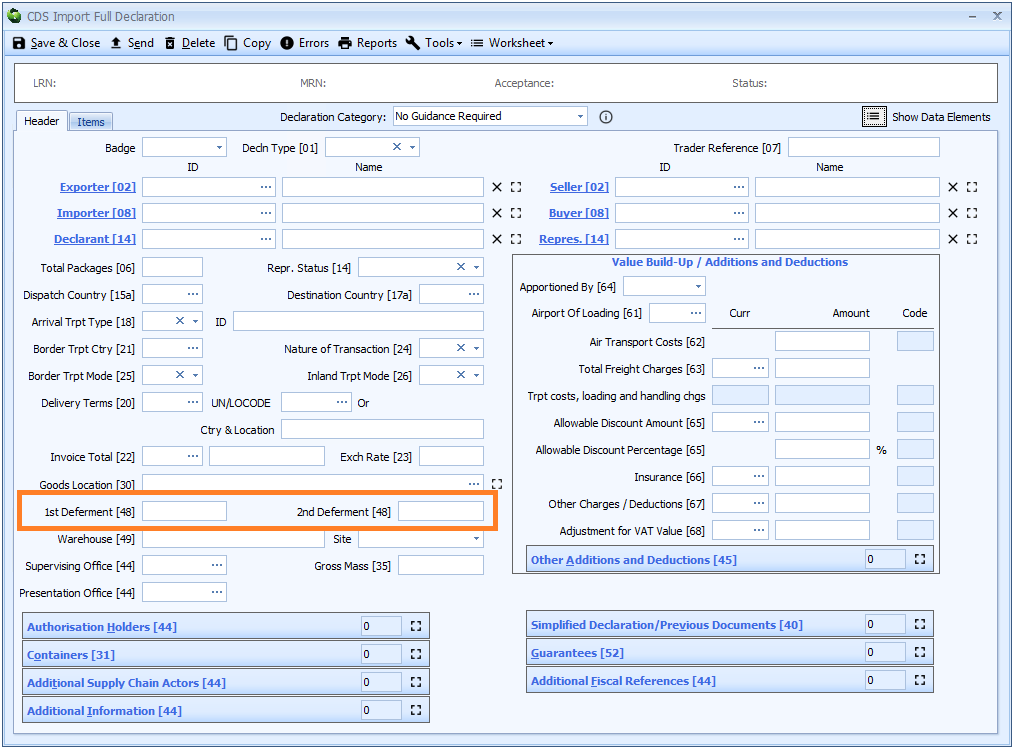

[2/6] Deferred payment (SAD box 48)

As with CHIEF declarations, you can specify up to 2 deferment numbers, against which revenue can be charged. For CDS, only the 7 digit deferment approval number is required. See [here] for details of how revenue is allocated if more than one deferment number is declared.

If the CRM records for the importer and declarant are configured correctly then the deferment number will be filled in automatically. See Information from CRM Records - Completing declarations automatically for details of how to do this.

Deferment numbers are declared on the header tab of the declaration form.

Unlike CHIEF declarations, there is more involved in using a deferment in CDS than simply declaring the 7 digit number. There are other data elements to complete. These are detailed below.

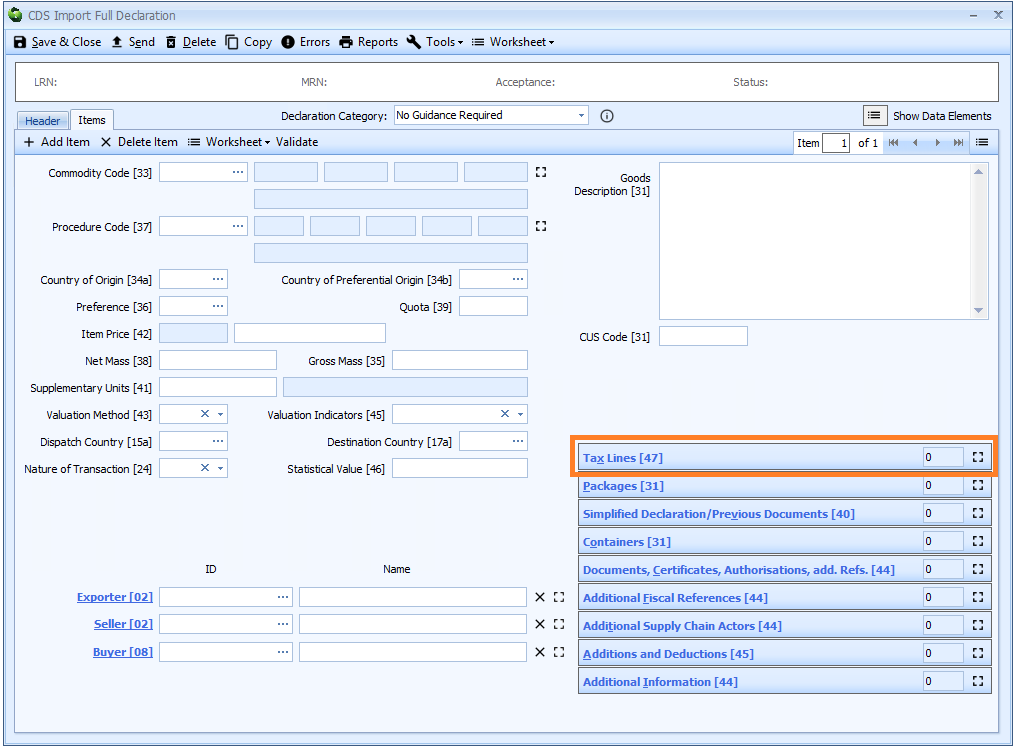

Tax Lines

There is normally no need to declare tax lines, other than the Method of Payment. This only has to be declared on one tax line on one item.

No other tax line information (not even tax type - e.g. A00 - is required.)

If the CRM records for the importer and declarant are configured correctly then the MoP code will be filled in automatically, on the first tax line of the first declaration item. See Information from CRM Records - Completing declarations automatically for details of how to do this.

Authorisation Holder

For declarations to CDS, if you declare a deferment number, you also have to declare a [3/40] Authorisation Holder in box 44 at header level to confirm the party authorised for that deferment account.

An Authorisation Holder will also automatically be added to the declaration when a deferment number is included, if that deferment number is stored in the CRM record of the importer or declarant. That Authorisation Holder declaration includes a code -

DPO- and the EORI number of the holder of the authorisation.

Documents

If the declaration will result in customs duty being due, then you must declare the following documents.

| Code | Reference | Status | Reason | Comments |

|---|---|---|---|---|

| C505 | GBCGU + Guarantee reference number |

No status required | - | This document declaration will be automatically entered based on the CRM record of the importer or declarant. |

| C506 | GBDPO + 7 digit deferment number |

No status required | - | This document declaration will be automatically entered based on the CRM record of the importer or declarant. |

Other documents may be required in the declaration. See [2/3] Documents, certificates and authorisations (SAD box 44) for more information.

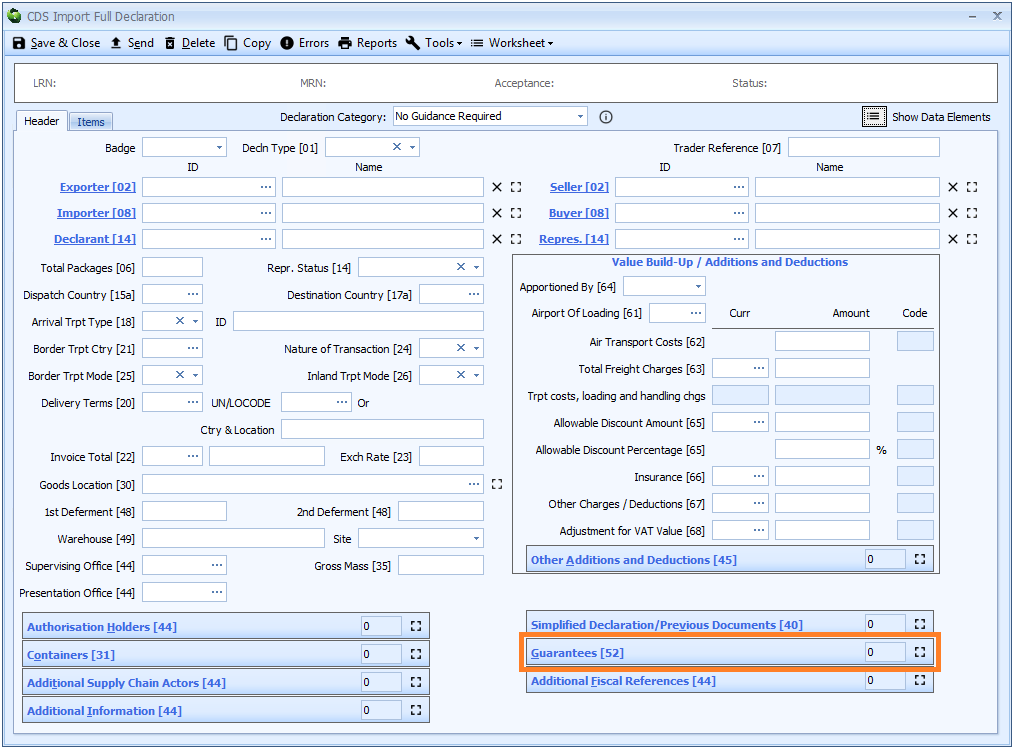

Guarantee

If the declaration will result in customs duty being due, then you must declare the guarantee under which the payment is covered. If the deferment account that you are using was authorised under the Union Customs Code then it will be covered by a Customs Comprehensive Guarantee (CCG).

An Authorisation Holder will also automatically be added to the declaration when a guarantee is included, if that guarantee is stored in the CRM record of the importer or declarant. That Authorisation Holder declaration includes a code -

CGU- and the EORI number of the holder of the authorisation.

Details of how to declare the guarantee can be seen at [8/2] Guarantee (SAD box 52)

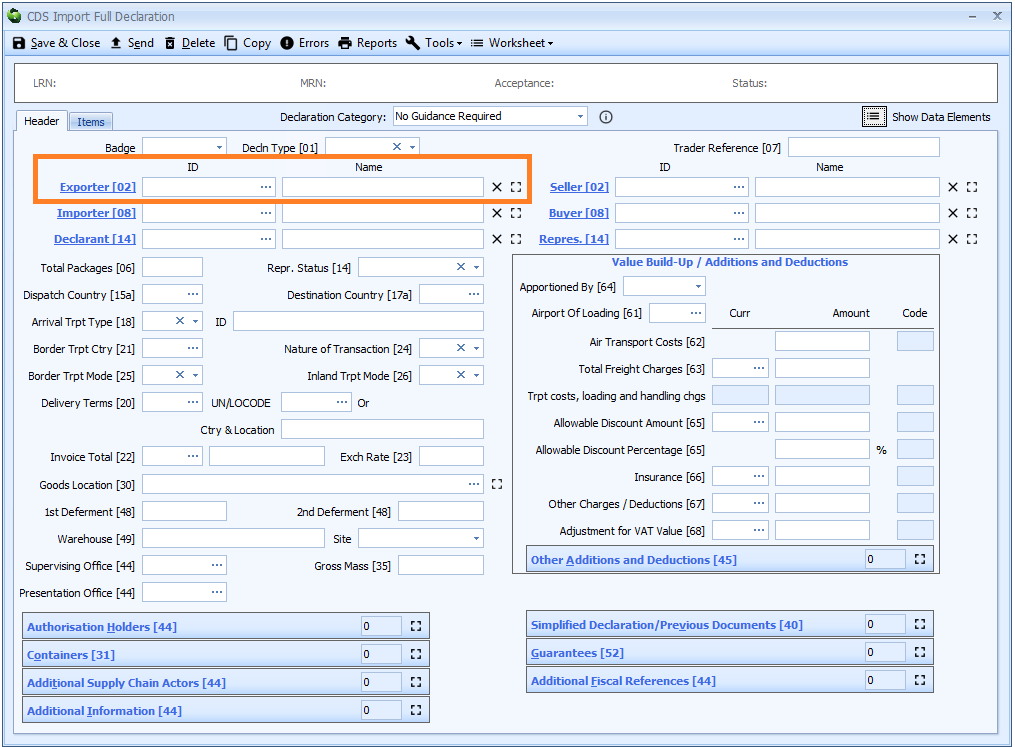

[3/1] Exporter (SAD box 2)

Either the ID or the full name and address (name, street, city, postcode and country code) must be declared.

If the declaration is created from an import job on which the consignor is specified, or the exporter is entered directly on the declaration form, then the exporter's ID and name and address details will be automatically filled in from those details recorded in the CRM record.

The exporter is normally declared on the header tab of the declaration form if the exporter is the same for all items, but can alternatively be declared on the item tab if not.

See [Completing Import CDS Declarations] for more information.

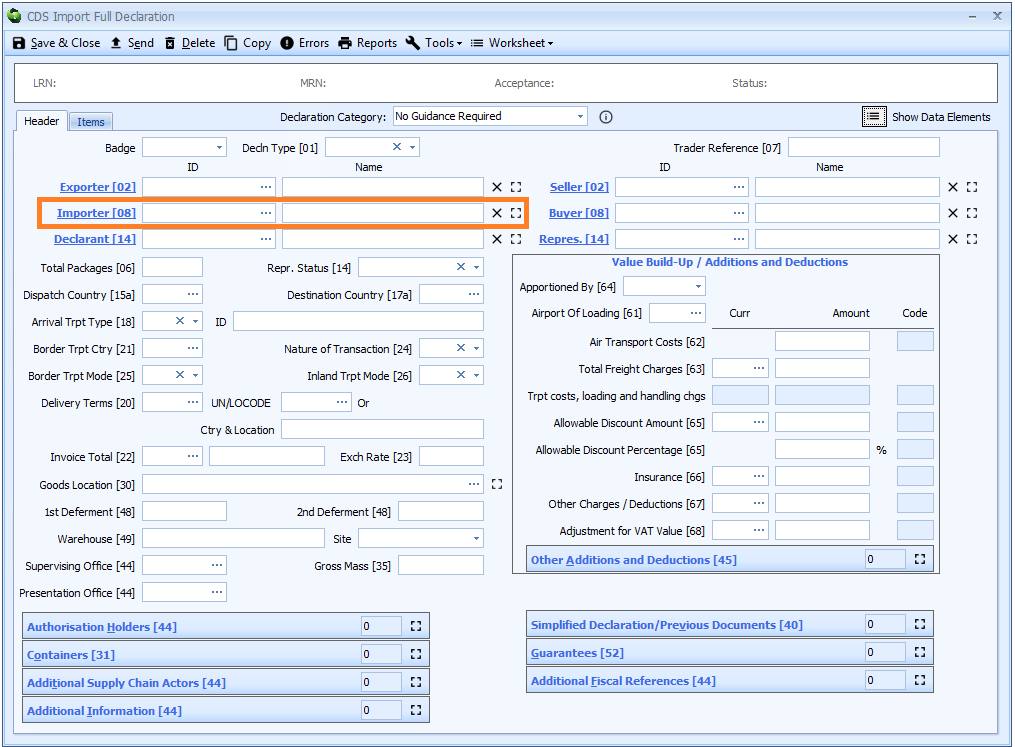

[3/16] Importer (SAD box 8)

Either the ID or the full name and address (name, street, city, postcode and country code) must be declared. If this is being filled in automatically from details available in a CRM record, then Sequoia will fill in both the ID and the name and address.

If the declaration is created from an import job on which the consignee is specified, or the importer is entered directly on the declaration form, then the importer's ID and name and address details will be automatically filled in from those details recorded in the CRM record.

The importer is normally declared on the header tab of the declaration form if the importer is the same for all items, but can alternatively be declared on the item tab if not.

See [Completing Import CDS Declarations] for more information.

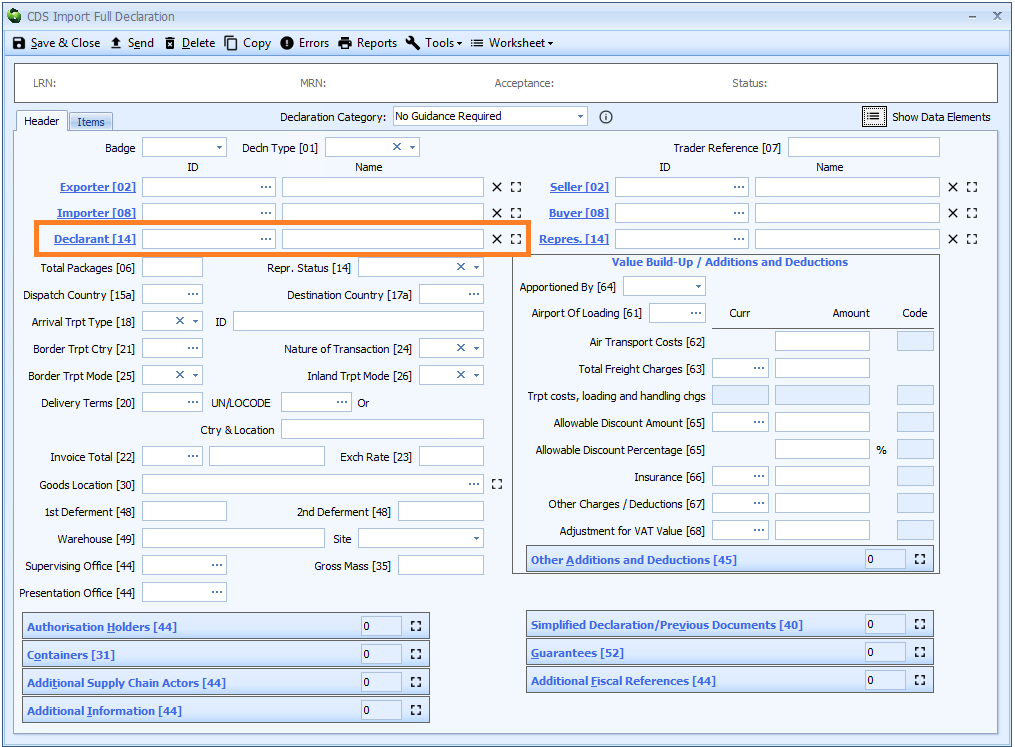

[3/18] Declarant (SAD box 14)

Either the ID or the full name and address (name, street, city, postcode and country code) must be declared. If this is being filled in automatically from details available in a CRM record, then Sequoia will fill in both the ID and the name and address.

If a default declarant is specified in a CRM record, then the declarant's ID and name and address details will be automatically filled in from those details recorded in that CRM record. See Information from CRM Records - Completing declarations automatically for details of how to do this.

The declarant is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

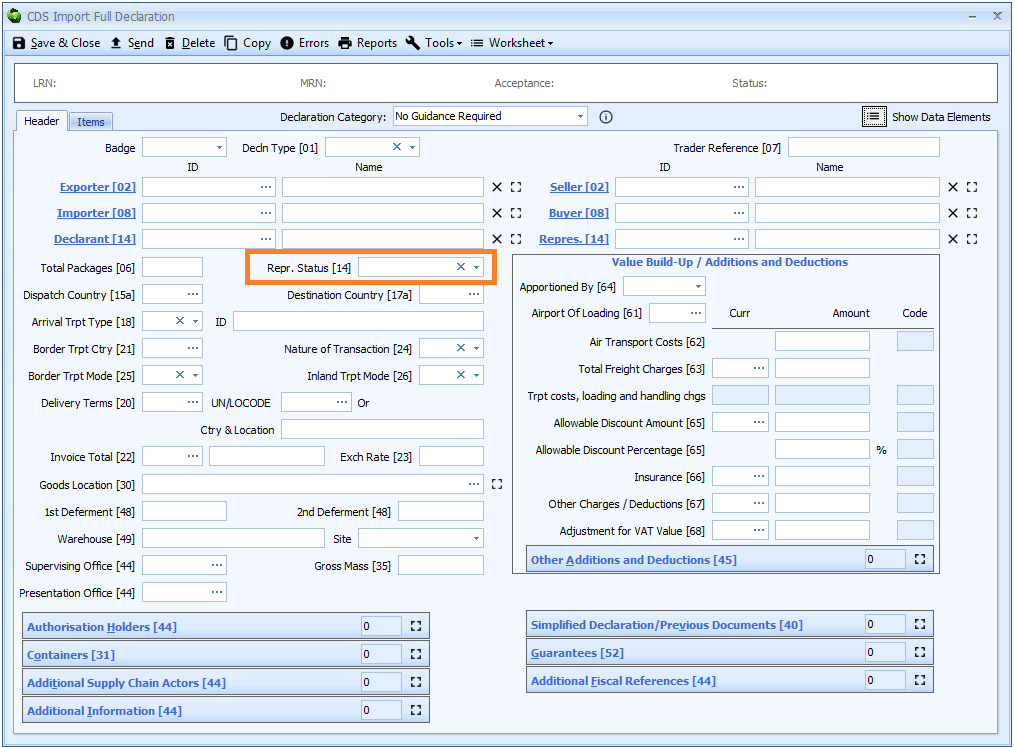

[3/21] Representative status (SAD box 14)

Complete the representative status; direct [2] or indirect [3].

If the representative status is specified in the CRM record of the importer, then that status will be automatically filled in from those details recorded in that CRM record. See Information from CRM Records - Completing declarations automatically for details of how to do this.

The status is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

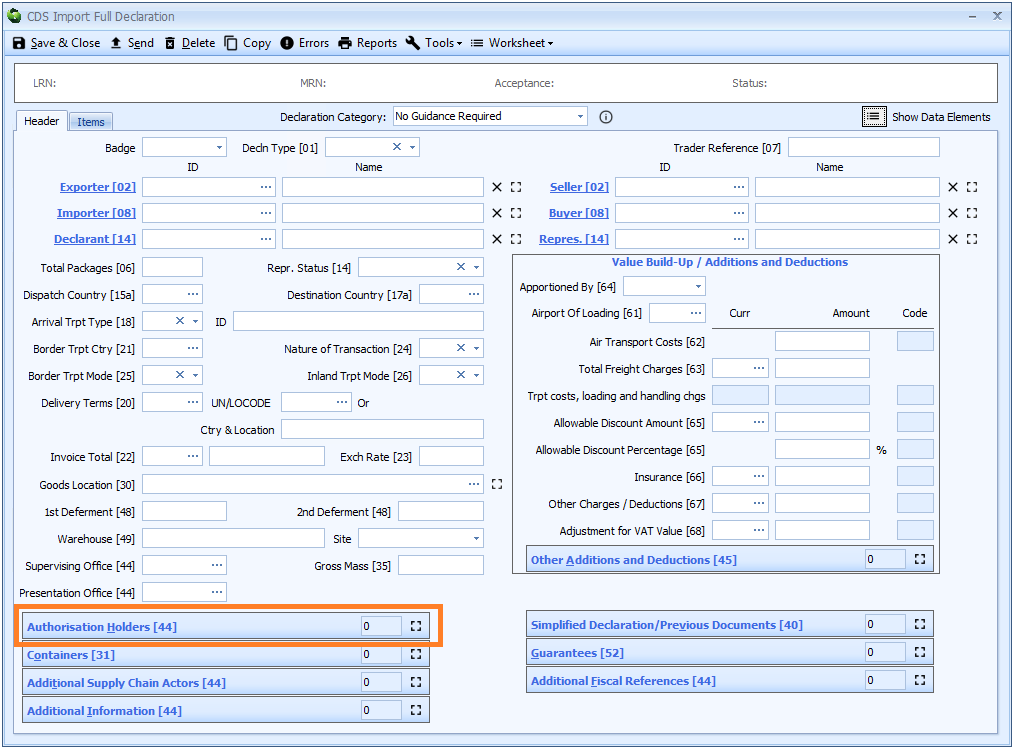

[3/39] Authorisation holders (SAD box 44)

In CDS declarations, it is not enough to declare a deferment number or a guarantee (or the use of special procedure authorisations etc). You also have to declare the holder of that authorisation, usually by specifying their EORI number along with a code identifying the type of authorisation.

Details of which authorisation holders are required when a deferment number is used, see [2/6] Deferred payment (SAD box 48).

Authorisation holders are declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

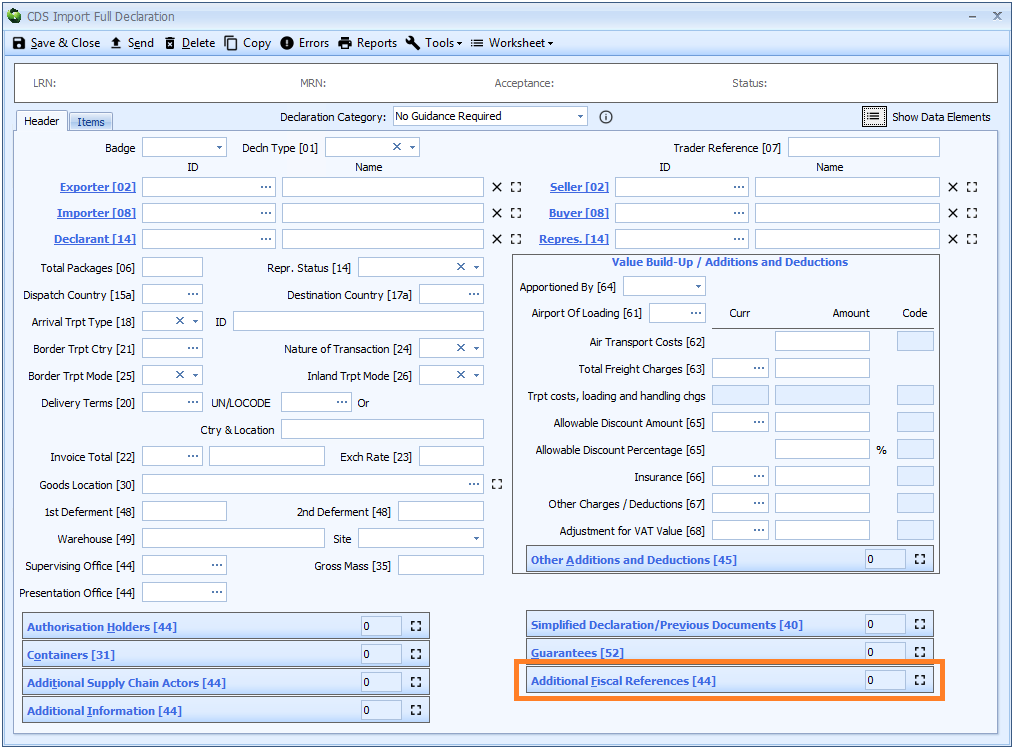

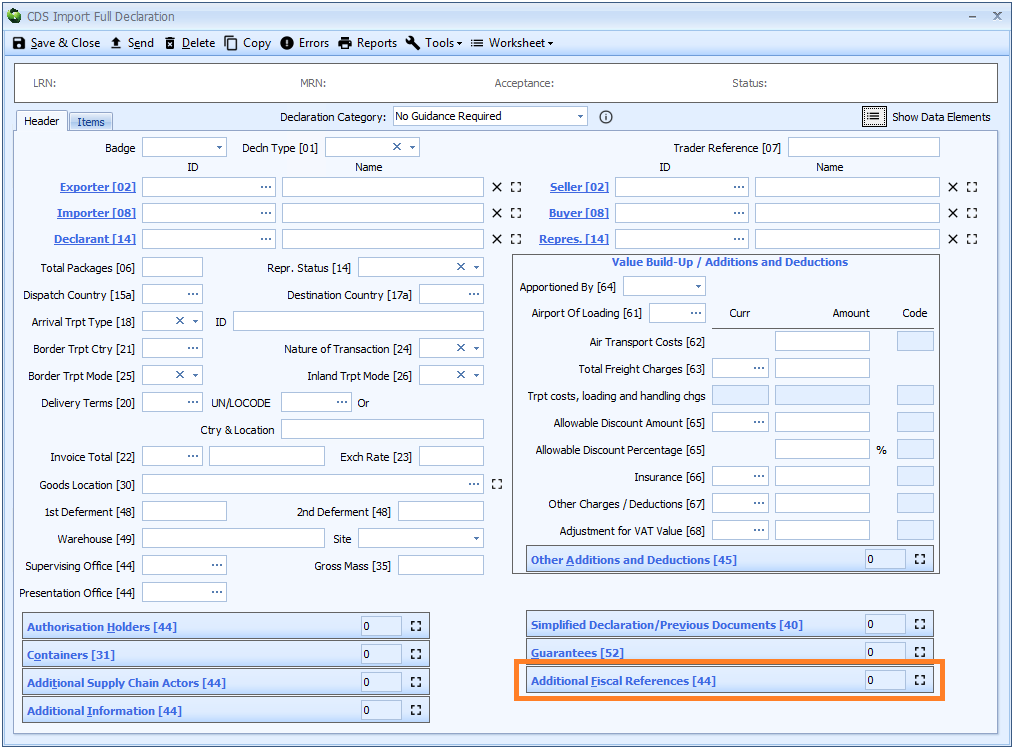

[3/40] Additional fiscal references (SAD box 44)

If the importer has opted for Postponed VAT Accounting (PVA) then an Additional Fiscal Reference must be declared. This consists of the following:

| Role | Identifier |

|---|---|

| FR1 | The VAT number of the importer, prefixed with GB.This is NOT the EORI number. It is the 9 digit VAT number. |

If the importer has opted for Postponed VAT Accounting (PVA) then you can configure their CRM record so that this Additional Fiscal Reference is automatically applied to declarations where they are specified as the importer. See Completing declarations automatically for details of how to do this.

An additional fiscal references in respect of PVA is declared on the header tab of the declaration form.

Additional fiscal references are declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

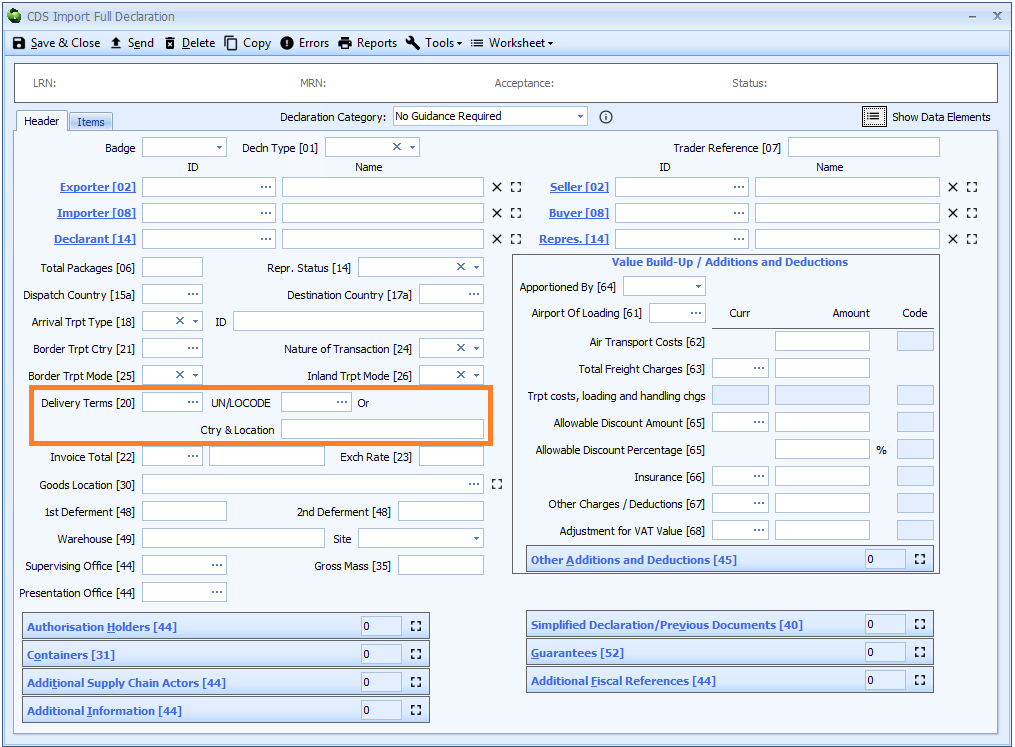

[4/1] Delivery terms (SAD box 20)

Enter the delivery term (Incoterm) under which the goods were shipped.

If there is a client relationship record set up for the importer/exporter/customer combination, then you can configure that relationship record to include the delivery terms if they are always the same. See Completing declarations automatically for details of how to do this.

Delivery terms are declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[4/8] Tax lines (SAD box 47)

There is normally no need to declare tax lines, other than the Method of Payment. This only has to be declared on one tax line on one item.

No other tax line information (not even tax type - e.g. A00 - is required.)

If the CRM records for the importer and declarant are configured correctly then the MoP code will be filled in automatically, on the first tax line of the first declaration item. See Information from CRM Records - Completing declarations automatically for details of how to do this.

Claiming a reduced or zero rate of VAT

Unlike with CHIEF declarations, in CDS you do not indicate entitlement to a reduced or zero rate of VAT by indicating the rate (R or Z) on a tax line.

Rather you indicate this entitlement by means of a [commodity additional code in DE 6/16 and 6/17].

For example, to indicate an entitlement to zero rated VAT, you have to declare a commodity additional code of VATZ on this item.

Declaring liability to excise and other duties

Unlike with CHIEF declarations, in CDS you do not indicate liability to excise, anti-dumping or similar duty by including a tax line.

Rather you indicate this by means of a [commodity additional code in DE 6/16 and 6/17].

Tax lines are declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

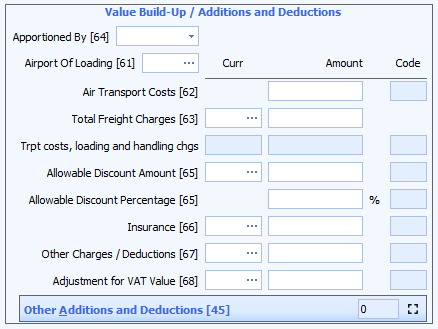

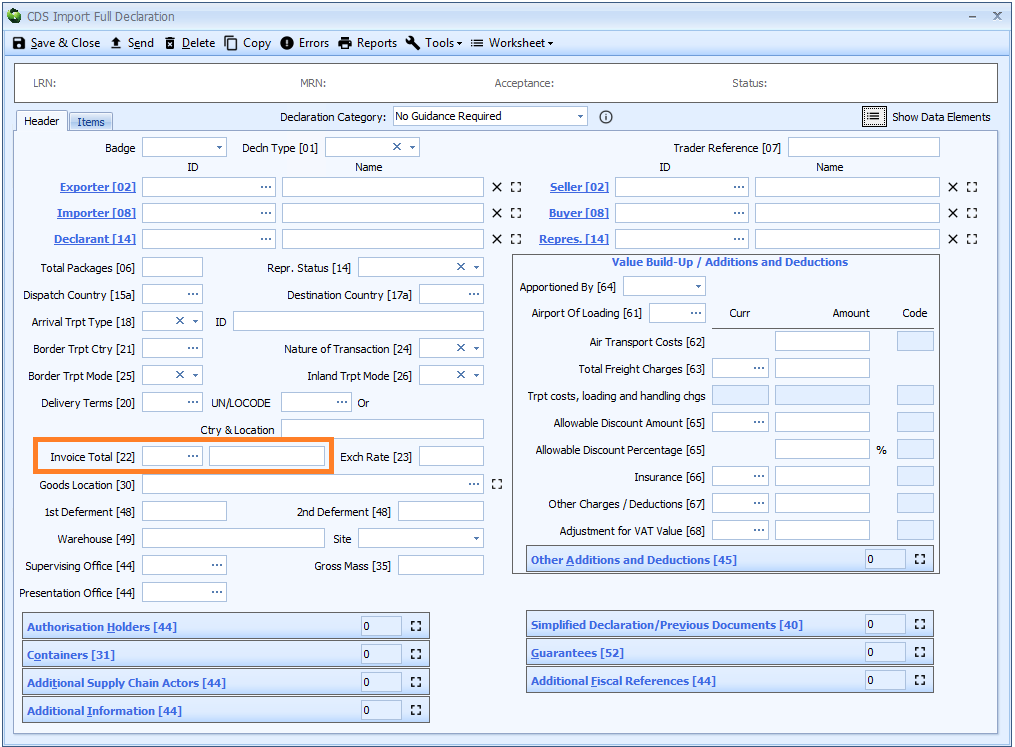

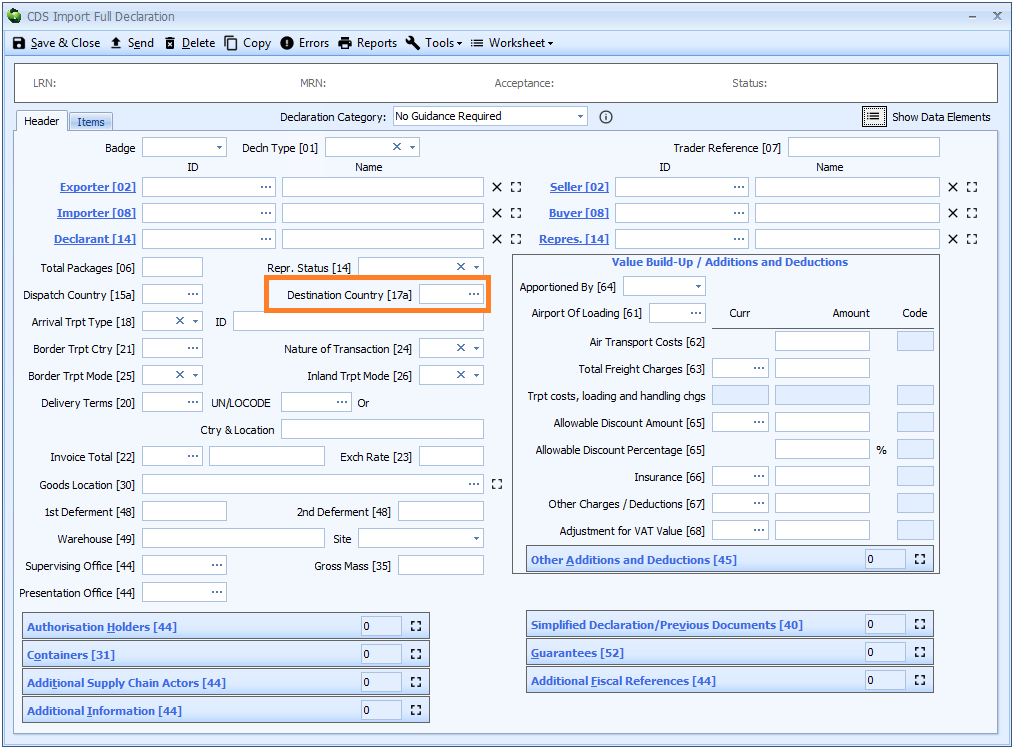

[4/9] Additions and deductions (SAD box 45)

With declarations to CHIEF, common additions to and deductions from the invoice value of the goods, which would affect the customs value of the goods, were declared in boxes 61 - 68 - commonly known as 'Value Build-Up (VBU)'. Other additions and deductions (such as royalties and commissions etc.) were declared on form C105A (DV1), but only when the value of the goods exceeded GBP7,500.

For CDS, all appropriate additions and deductions are declarable regardless of the value of the goods. HMRC have provided specific codes that map to CHIEF VBU, and these have been included in Sequoia - on the declaration header page - in such a way as to reflect the CHIEF VBU boxes (as shown below).

Other additions and deductions are declared on either the header or item tab on the declaration form.

See [Completing Import CDS Declarations] for more information.

[4/10] Invoice total (SAD box 22)

The invoice total is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

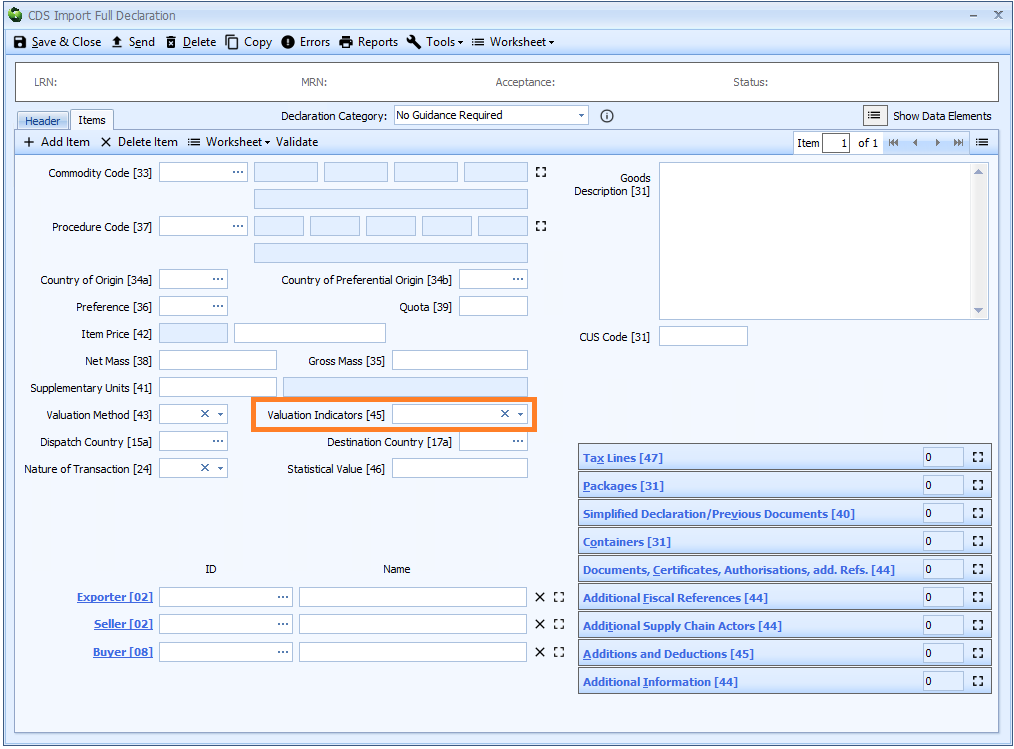

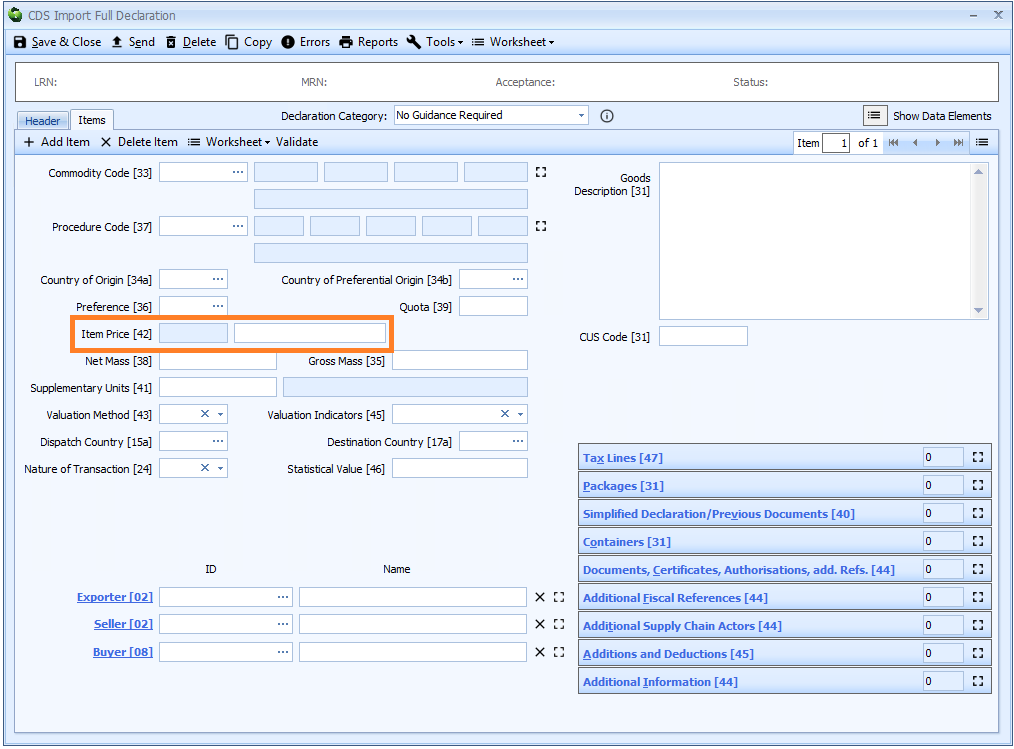

[4/13] Valuation indicators (SAD box 45)

Valuation indicators are required for declarations using Valuation Method 1 - the transaction value of the goods. Otherwise they should be left blank.

Valuation indicators are declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[4/14] Item price (SAD box 42)

The item price is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

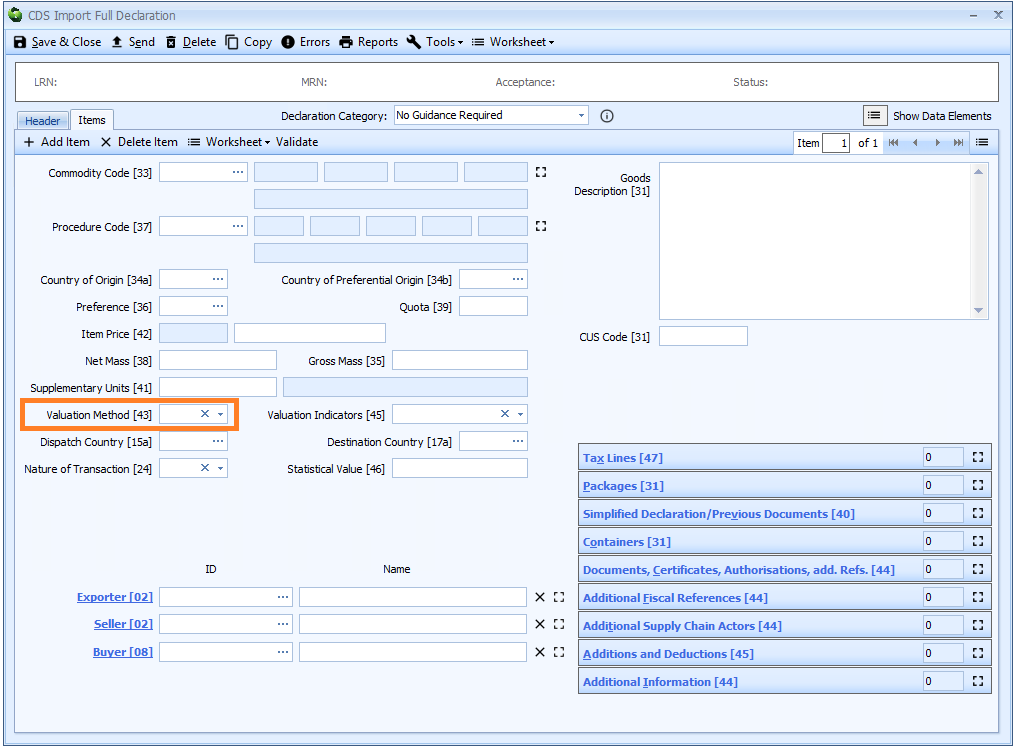

[4/16] Valuation method (SAD box 43)

The valuation method must be completed for all items on the declaration.

The valuation method is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

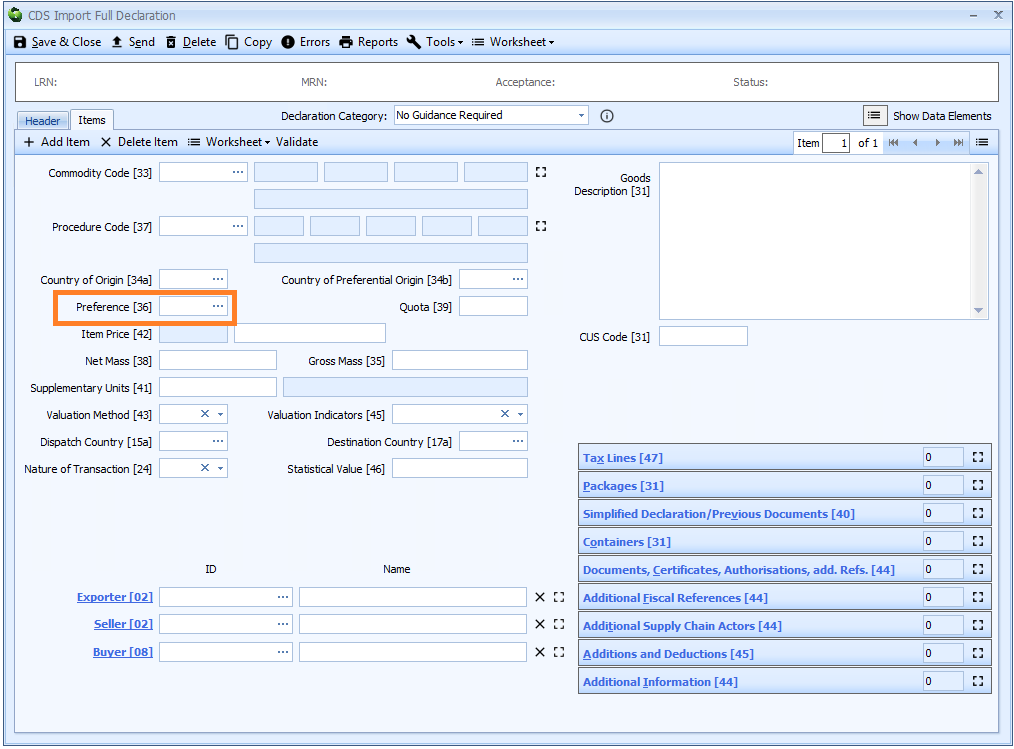

[4/17] Preference (SAD box 36)

A preference code is mandatory for all imports where the goods are:

- entering a free circulation regime (including end use)

- where a claim to tariff preference or quotas is established upon entry to the customs procedure

Preference is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[5/8] Destination country (SAD box 17a)

Destination country is mandatory. If it is the same for all the goods on the declaration then it should be entered at header level. Otherwise it must be declared for each item.

See [Completing Import CDS Declarations] for more information.

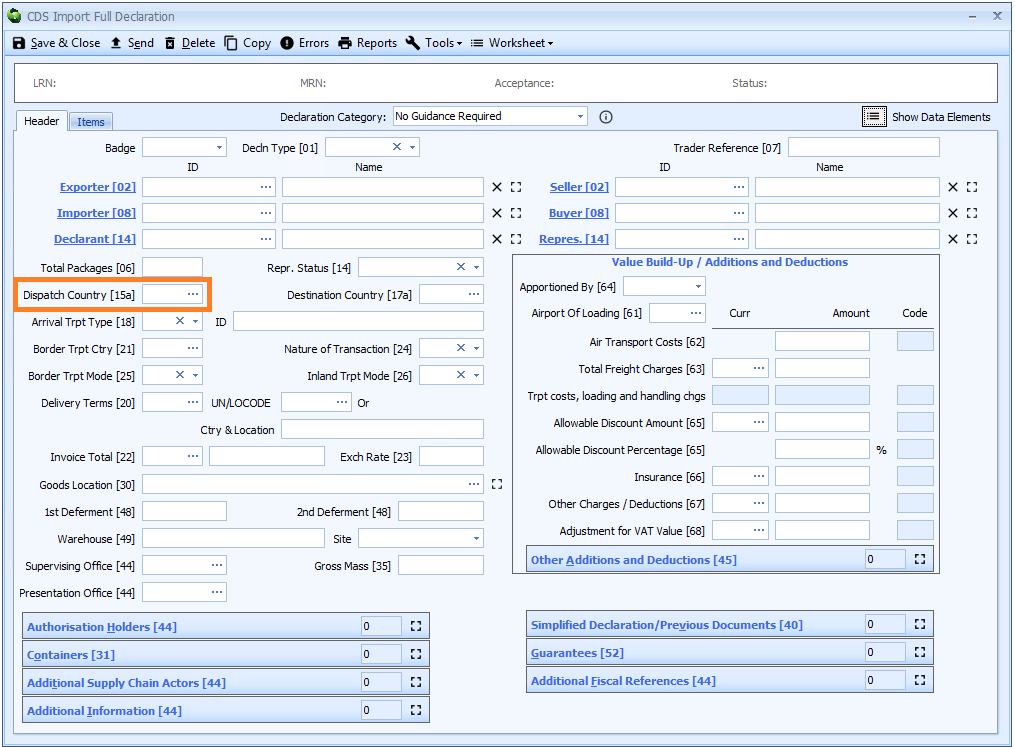

[5/14] Dispatch country (SAD box 15a)

Dispatch country is mandatory. If it is the same for all the goods on the declaration then it should be entered at header level. Otherwise it must be declared for each item.

See [Completing Import CDS Declarations] for more information.

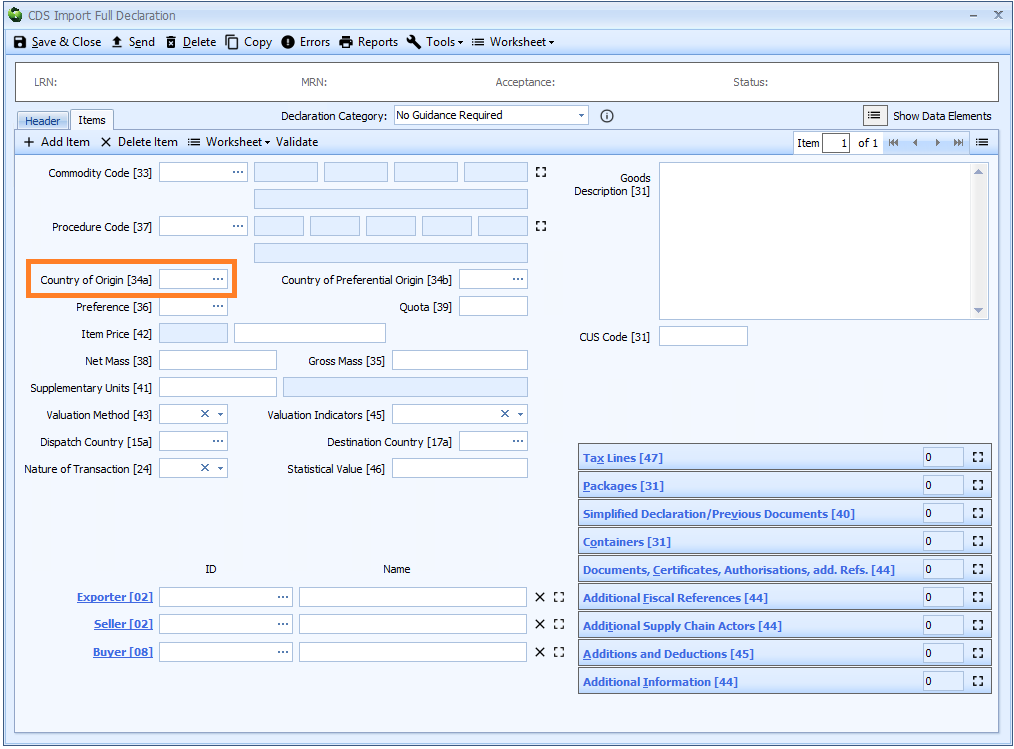

[5/15] Origin country (SAD box 34a)

The country of origin is mandatory if the preference code entered in box 36 begins with 1 (i.e. you are not claiming preference). If you are claiming preferential treatment then you will have to complete Box 34b - Country of Preferential Origin (see below).

In those circumstances, this box (34a) is only required if the country of non-preferential origin is different to the country of preferential origin.

The country of origin is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

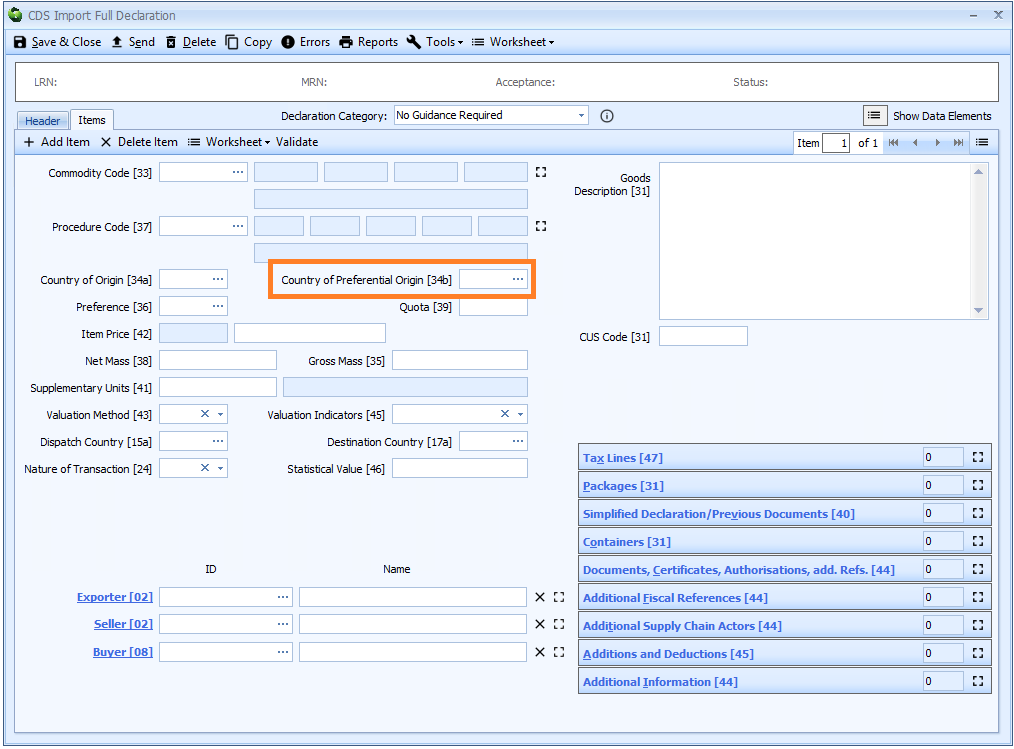

[5/16] Preferential Origin country (SAD box 34b)

The country of preferential origin is mandatory if you are claiming preference - i.e. the preference code entered in box 36 does not begin with 1.

The country of preferential origin is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[5/21] Place of loading (SAD box 27)

The place of loading is the equivalent of Value Build Up box 61 in a CHIEF declaration and only requires completion in the same circumstances.

See [Additions and deductions] for details.

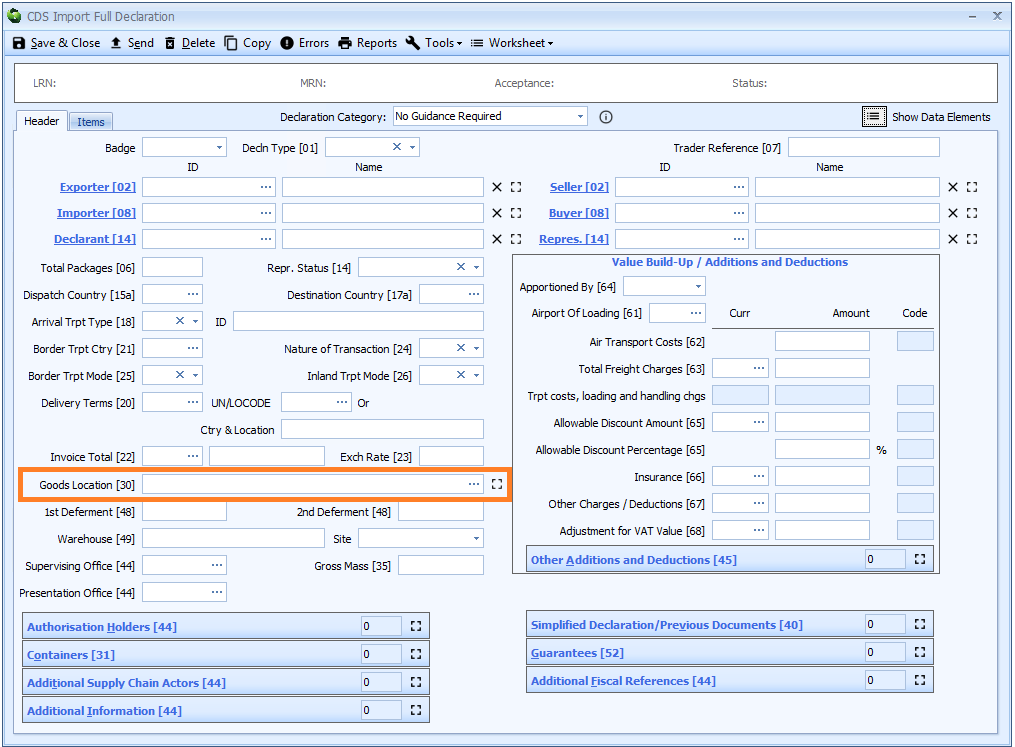

[5/23] Location of goods (SAD box 30)

Location of goods is mandatory for a declaration to home use.

The location of goods is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

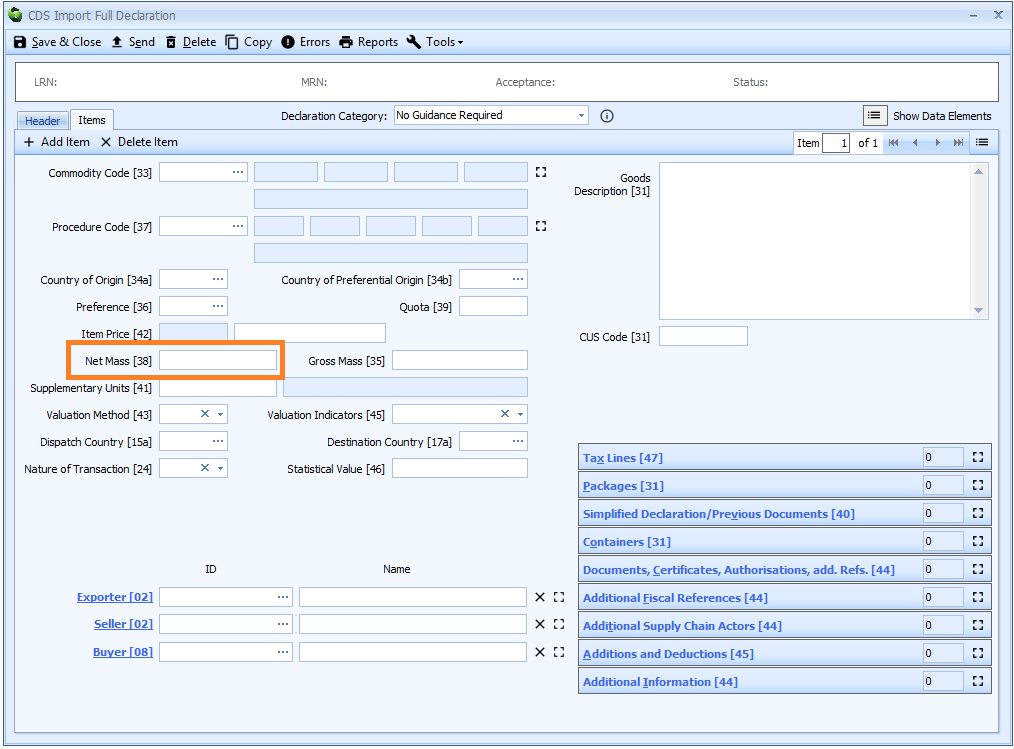

[6/1] Net mass (SAD box 38)

Net mass is mandatory for a declaration to home use.

Net mass is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

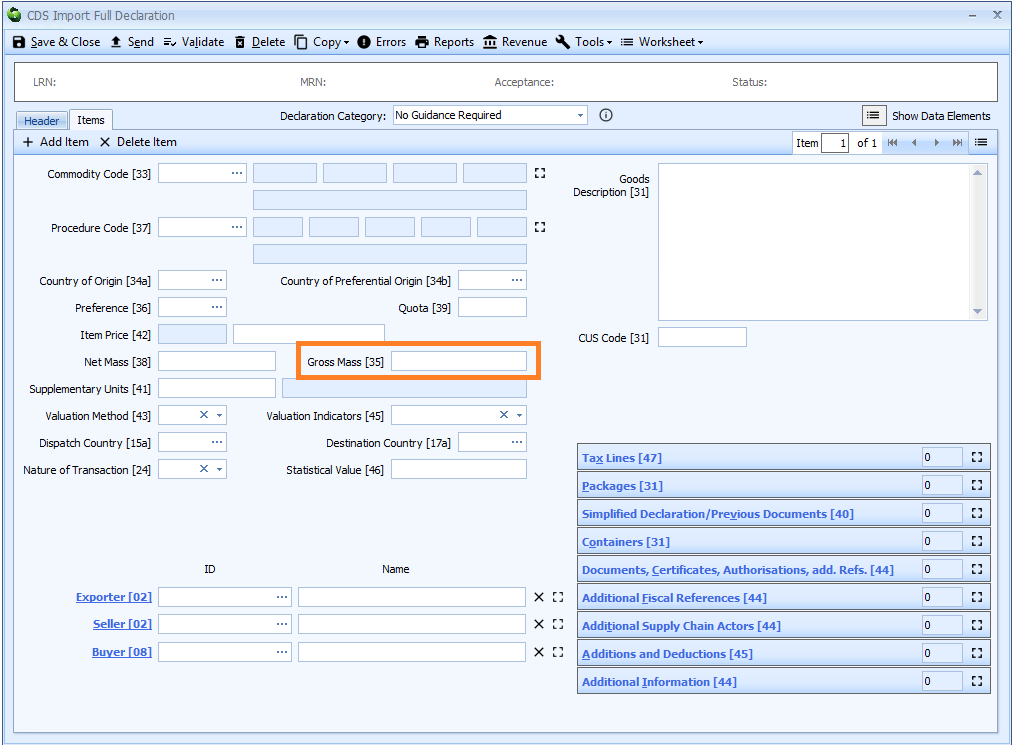

[6/5] Gross mass (SAD box 35)

Gross mass is mandatory for a declaration to home use.

Gross mass is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

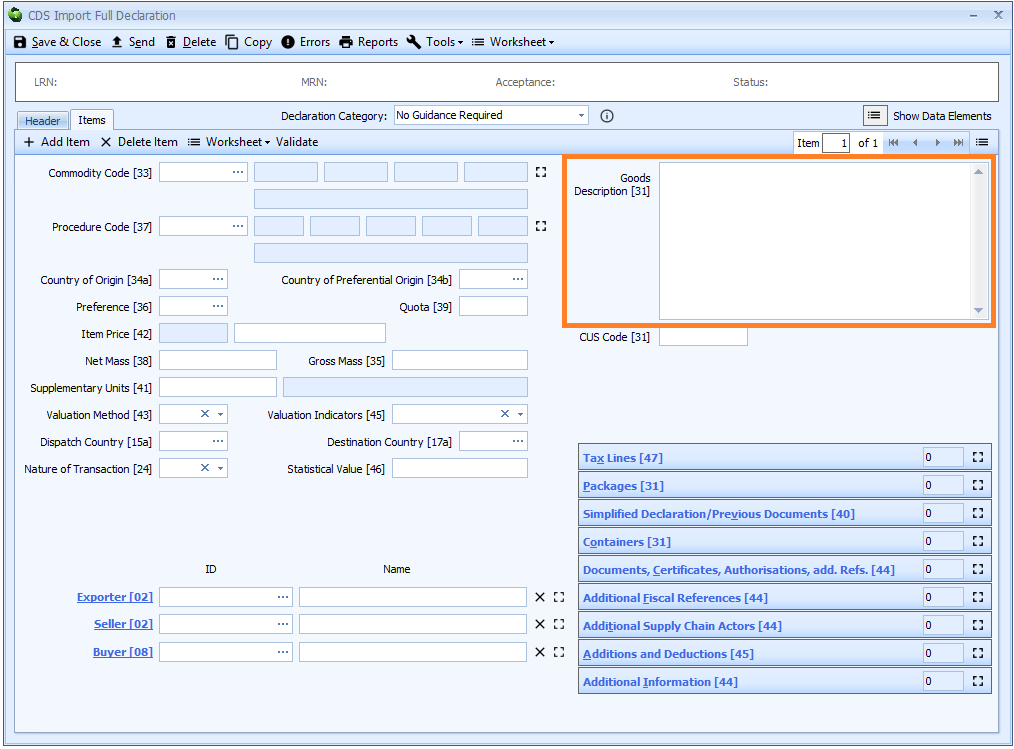

[6/8] Description of goods (SAD box 31)

Description of goods is mandatory for a declaration to home use.

Description of goods is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

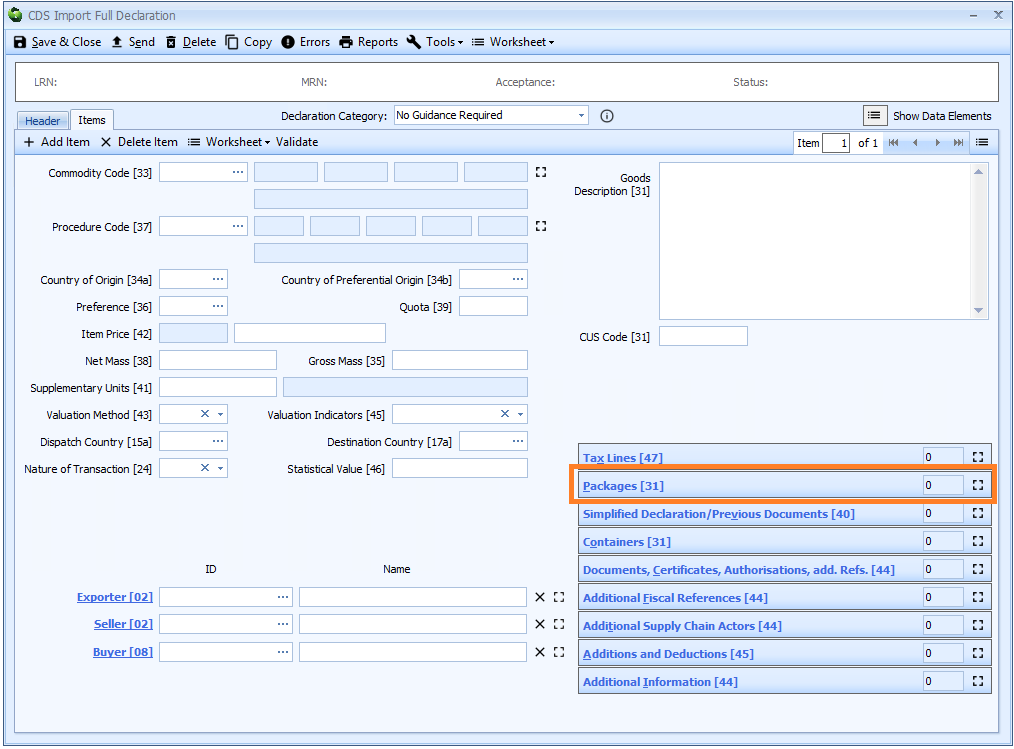

[6/10] Packages (number, kind and marks) (SAD box 31)

Packages (number, kind and marks) are mandatory for a declaration to home use.

Packages are declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[6/14 + 6/15] Commodity code (SAD box 33)

The 10 digit commodity code is mandatory for a declaration to home use.

The commodity code is declared on the item tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[6/16 + 6/17] Commodity additional code (SAD box 33)

Unlike with CHIEF declarations, in CDS you do not indicate entitlement to a reduced or zero rate of VAT by indicating the rate (R or Z) on a tax line.

Rather you indicate this entitlement by means of a commodity additional code. For example, to incate an entitlement to zero rated VAT, you have to declare a code of VATZ.

Also in CDS you do not indicate liability to excise, anti-dumping or similar duty by including a tax line. You indicate this also by means of a commodity additional code.

Any such codes are indicated in the online tariff on gov.uk.

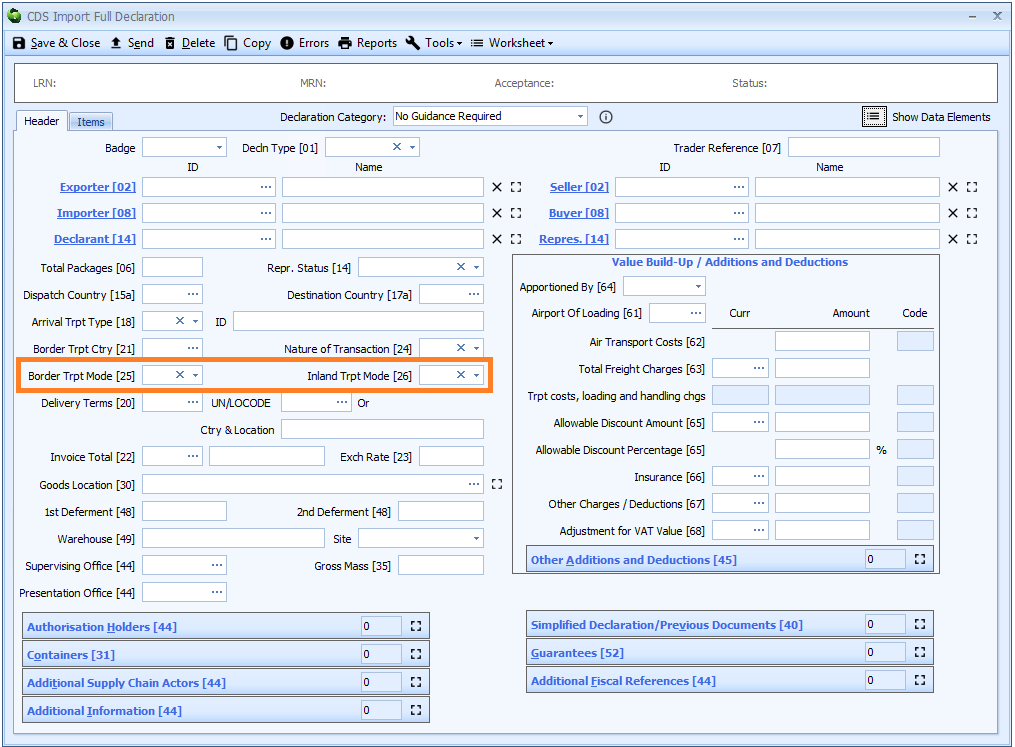

[7/4] Border transport mode (SAD box 25)

Border transport mode is mandatory for a declaration to home use.

Border transport mode is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

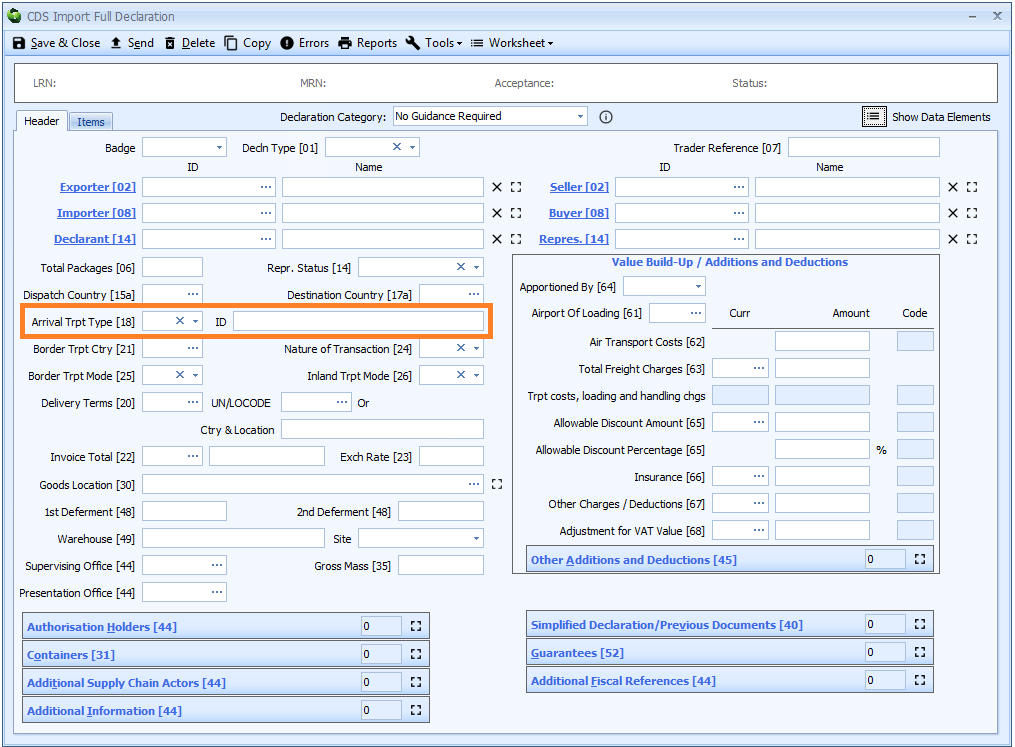

[7/9] Arrival transport type and ID (SAD box 18)

Both Arrival transport type and ID should be declared.

Arrival transport type and ID are declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

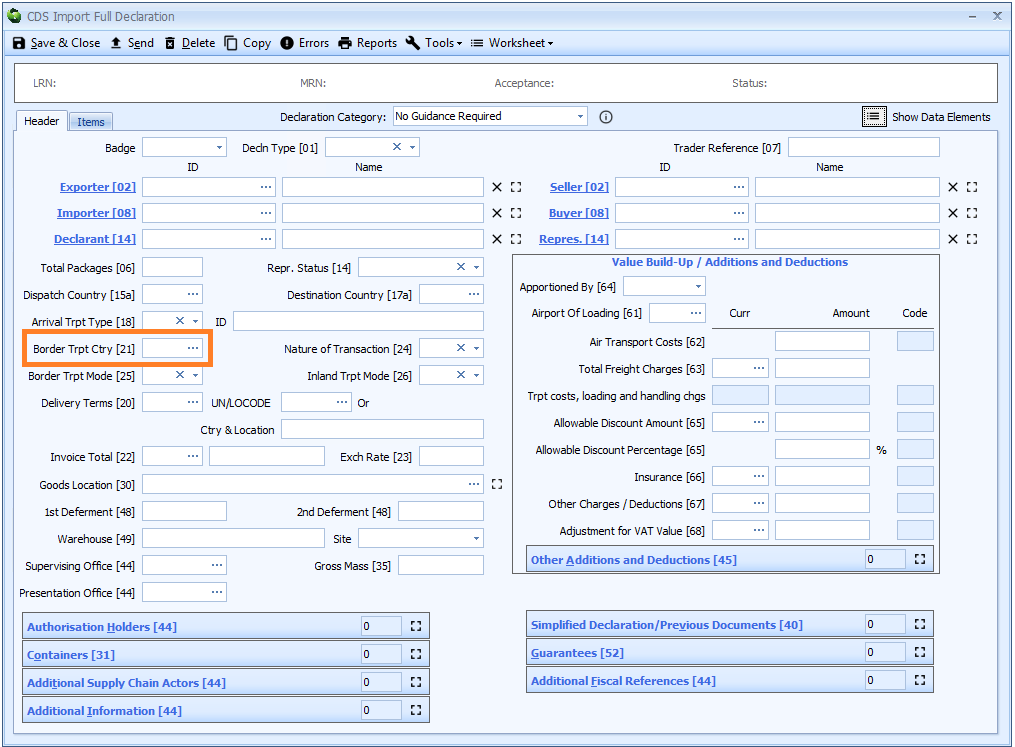

[7/15] Border transport nationality (SAD box 21)

Border transport nationality is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

[8/2 + 8/3] Guarantee (SAD box 52)

A guarantee is typically required if:

- A deferment number is used to defer the payment of customs duty, or;

- A cash account is being used to pay customs duty

If the CRM records for the importer and/or declarant are configured correctly then the guarantee details will be filled in automatically. See Information from CRM Records - Completing declarations automatically for details of how to do this.

The guarantee is declared on the header tab of the declaration form.

See [Completing Import CDS Declarations] for more information.

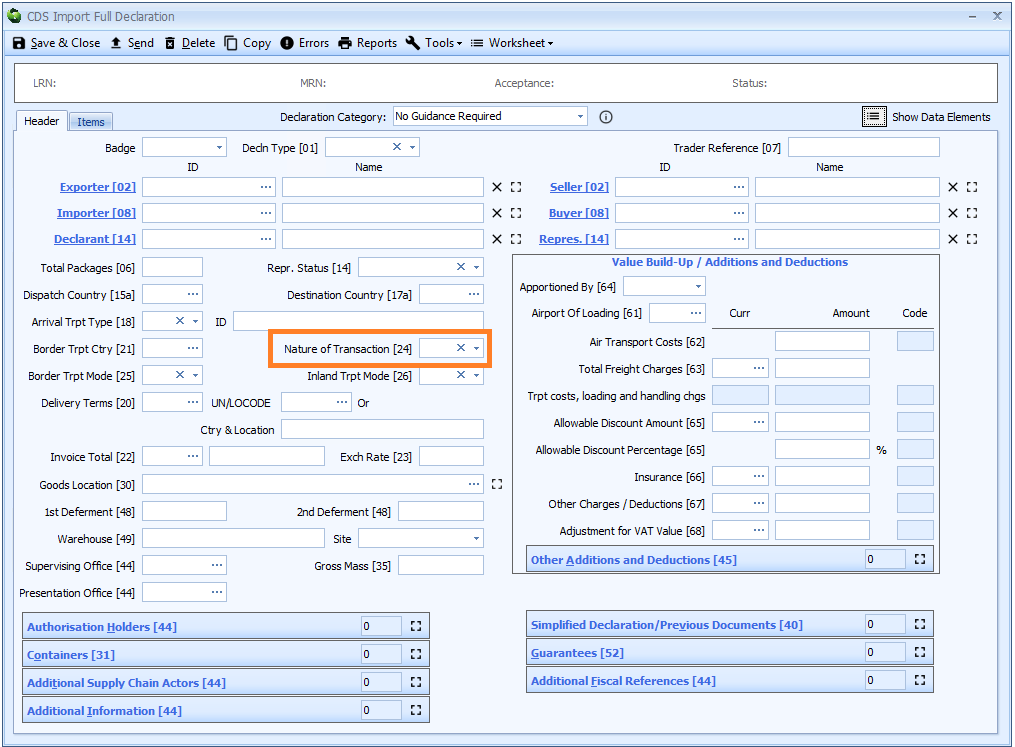

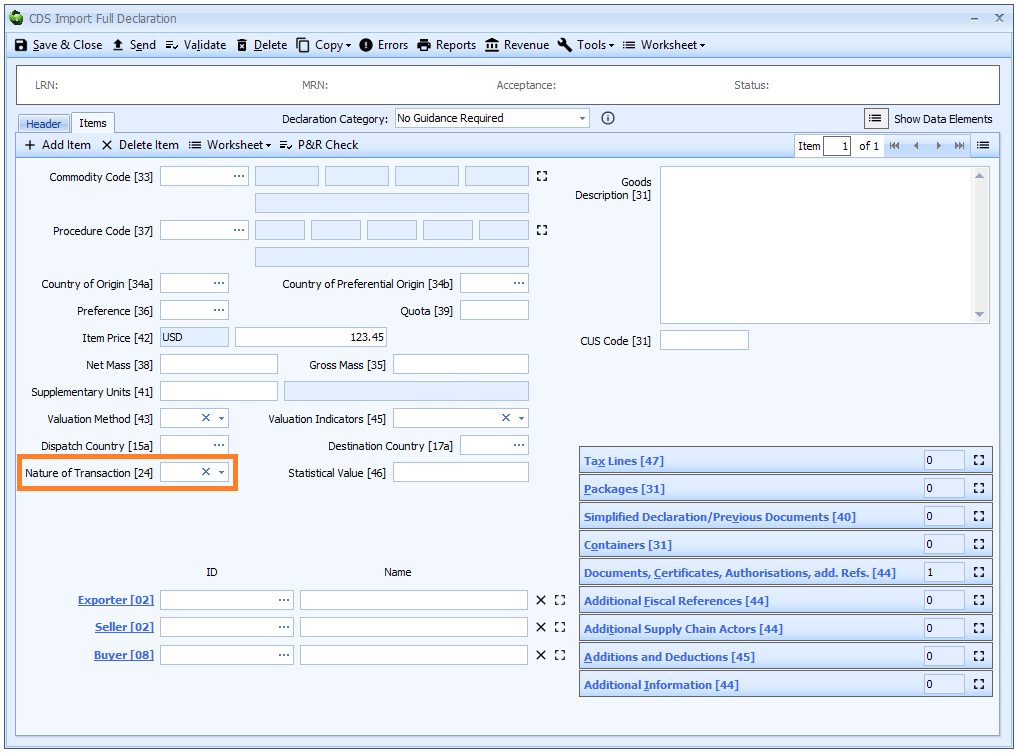

[8/5] Nature of transaction (SAD box 24)

Nature of transaction is mandatory for a declaration to home use.

Nature of transaction is declared on the header tab of the declaration form where it is the same for all items. Otherwise it is declared on the item tab.

See [Completing Import CDS Declarations] for more information.