Procedures to follow in the event of Fallback being invoked

Overview

The existing manual procedures when CHIEF is unavailable require a lot of manual intervention. The recovery after the fallback period also requires manual reconciliation to ensure that all declarations have been completed.

This complexity has historically proved to be impractical, resulting in a reluctance by HMRC to invoke fallback in the event of service interruption and long delays and disruption to trade.

For this reason CCS-UK has developed an electronic fallback system for the air community which allows fallback to be more easily invoked, easily operated and to make recovery after fallback a simple and auditable procedure. More importantly it allows air cargo to continue to be exported and imported with little or no change to existing procedures.

The electronic fallback system has been designed to operate for air imports and air exports independently or both together, depending on the circumstances of any service interruption.

Functionality to allow you to function in the air environment during a period of fallback has been introduced in Sequoia. This guide is intended to describe how the system works and the steps to take in Sequoia to ensure as little disruption as possible.

CCS-UK constantly monitors the message exchange with CHIEF. If this exchange is significantly disrupted an alert is automatically generated and the CCS-UK helpdesk will notify users that CHIEF is not available and that fallback may be invoked.

Import Fallback

Introduction

All agents can continue to submit import declarations during a period of fallback.

When fallback for imports is invoked a GENRAL text message will be sent to all forwarders and Airline/Transit Shed systems to advise users that fallback is in progress.

Fallback Operation

There are no changes required to forwarder or transit shed systems to process imports under CCS-UK automated import fallback.

Transit Sheds (including ETSF operators) and Airlines will continue to create inventory consignment records as normal during fallback. Removal requests (inter-shed, inter-airport and transhipment) will also continue to function as normal as these are processed on CCS-UK and not CHIEF.

Once you have been notified that import fallback is likely to be invoked, agents who are AEO accredited should - before submitting declarations - identify innocent goods; i.e. those goods which normally receive a route 3 or 6 response from CHIEF.

For these goods a header level Additional Information (AI) Statement with code FBK03 should be added to these declarations before they are submitted.

Where this is not the case - or you are not AEO accredited - a declaration can still be submitted but the AI Statement must be omitted.

CCS-UK will process declarations from AEOs with the FBK03 AI statement and (subject to customs profile checks) will issue a FALLBACK RELEASED status to

both the shed operator and the agent.

The transit shed/ETSF will then automatically produce a release note as normal which will allow the release of the goods.

No manual out of charge note is required.

Note that in normal operation, a customs status of

CAis applied to consignments awaiting clearance (e.g. when a declaration is accepted but not yet cleared).In fallback, both held and released consignments will have a customs status code of

CA.

If you are not AEO accredited then you must not declare an FBK03 header level AI statement but you can still submit declarations.

You will receive a FALLBACK HOLD status for each declaration submitted during fallback. This also applies to any declarations from AEO agents where the FBK03

AI statement is not included.

To effect release of a consignment with a status of FALLBACK HOLD you should contact the HMRC National Clearance Hub (NCH) with the necessary documentation.

The NCH can manually release consignments during fallback where appropriate.

Recovery After Fallback

When fallback is revoked, another GENRAL message will be sent to all forwarders and Airline/Transit Shed systems to advise you that fallback is no longer in operation. Declarations that have been stored by CCS-UK during fallback will then be forwarded to CHIEF in the normal way.

Note that this could result in a consignment that was released during fallback being subsequently selected for examination (route 1 or 2) by CHIEF. Anomalies such as this will be resolved through liaison with the NCH until the consignment is customs cleared.

Export Fallback

Introduction

When fallback for exports is invoked a GENRAL text message will be sent to all forwarders and Airline/Transit Shed systems to advise users that fallback is in progress.

All agents can (and should) continue to submit export declarations during a period of fallback.

Fallback Agent Types

From an export fallback system point of view, there are two types of forwarders.

| Type | Description |

|---|---|

| Type 1 | You are only allowed to dispatch goods for which an export declaration has been accepted, arrived and has permission to progress or for goods which have a specific Customs Authorisation Reference. |

| Type 2 | You are allowed to dispatch goods which may have no export declaration, arrival or permission to progress or specific customs authorisation reference (although the latter may be required for certain types of goods - OPR, goods subject to licence etc). You are not allowed to export goods that have been selected for examination (Route 1 or 2) in a DEP unless those goods have already been released (P2P) prior to fallback being invoked or for which you have a specific Customs Authorisation Reference for them. AEO accredited agents are automatically considered to be Type 2 agents for the purposes of fallback. This needs to be configured in Sequoia for the fallback process to function correctly. Sequoia stores the type of agent you are in its Administration console. By default you will be configured as a type 1 forwarder. See Configuration of Agent Type below for details. |

Fallback Operation

When fallback for exports is invoked a GENRAL text message will be sent to all forwarders and Airline/Transit Shed systems to advise users that fallback is in progress. Sequoia will automatically set the export fallback mode on receipt of this message. To check the current mode or to set it manually see Manually setting fallback mode below.

Whether you are a Type 1 or a Type 2 forwarder for export fallback, we strongly advise you to continue to process export consignments in the normal way during a period of fallback. You should continue to submit declarations and finalise shipments and consolidations in the normal way.

If you don't do this, you could experience difficulties once CHIEF is available again as any subsequent declarations for these shipments will not get automatically associated to a MUCR or arrived and departed correctly.'

Export declarations should continue to be submitted during a period of fallback . They (and other messages) are stored by CCS-UK and will be forwarded to CHIEF once normal service is resumed.

Type 1 agents

You are only allowed to dispatch goods for which an export declaration has already been accepted, arrived and has permission to progress (SOE=7) or goods which have a specific Customs Authorisation Reference (see Declaring a Customs Authorisation Reference below).

Sequoia will automatically take into account the different rules for agent type, declaration status and authorisation references when you finalise a shipment or consolidation in fallback.

Where a Customs Authorisation Reference has been issued by the NCH, a header level Additional Information (AI) Statement with code FBK01 should be added to

these declarations before they are submitted. The AI Statement Text should contain the Customs Authorisation Reference.

Other declarations can still be submitted but in those circumstances the AI Statement must be omitted.

Type 2 agents

Once you have been notified that export fallback has been, or is likely to be, invoked type 2 agents should - before submitting declarations - identify innocent goods; i.e. those goods which normally receive a route 3 or 6 response from CHIEF. You should also obtain a Customs Authorisation Reference where necessary - see Fallback Agent Types and Declaring a Customs Authorisation Reference.

Where a Customs Authorisation Reference has been issued by the NCH, a header level Additional Information (AI) Statement with code FBK02 should be added to these

declarations before they are submitted. The AI Statement Text should contain the Customs Authorisation Reference.

Other declarations can still be submitted but in those circumstances the AI Statement must be omitted.

Sequoia will automatically take into account the different rules for agent type, declaration status and authorisation references when you finalise a shipment or consolidation in fallback.

Declaring a Customs Authorisation Reference

Where a Customs Authorisation is required, you will have to contact customs (at the NCH) requesting authority to export the goods under fallback. Once customs are satisfied they will allocate a reference for the authorisation.

The reference has the following structure: EFBnn-abc-ynnnn

Where:

nn |

is a unique number (01-99) relating to a specific period of fallback |

abc |

is the badge code of the agent to whom the reference was allocated |

y |

is the level at which the authorisation was granted - M (Header) - C (Consignment) - D (Declaration) |

nnnn |

is a sequential number (4 digits) 0001-9999 |

For example: EFB01-XYZ-D1234

The reference can relate to a specific declaration (either existing or anticipated) or a specific consignment (e.g. where no - or more than one - declaration is subsequently to be submitted).

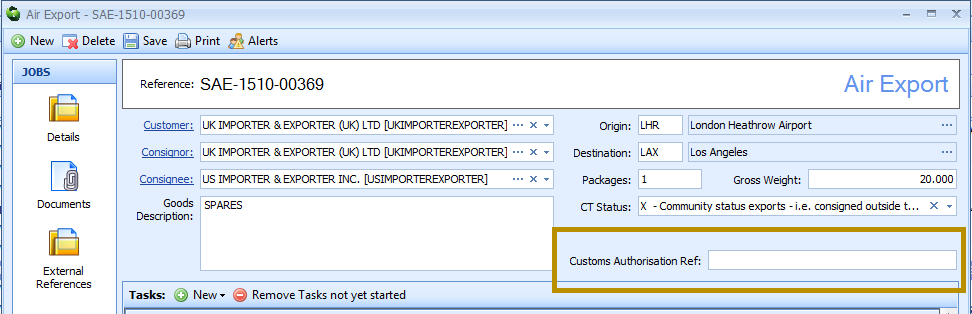

Once you have been given a Customs Authorisation Reference you must record it in Sequoia.

If you are a type 2 agent and haven't yet completed an export declaration (although we strongly advise you to do so) you should store the reference against the Sequoia job (as pictured below).

You should then make sure that this reference is included as a header level AI Statement when eventually a declaration is submitted for these goods.

If you are about to complete a declaration then you should declare the reference as a header level AI statement

with a code of FBK01 or FBK02 (depending on whether you are a type 1 or Type 2 agent) with

the Customs Authorisation Reference declared as the AI Statement Text.

If you have already submitted a declaration then you should amend and resubmit it with the AI statement included. If the declaration has a status of 'Submitted' - this may be the case until fallback has ended) then you should wait until the declaration has been accepted before you amend it.

Any declarations you submit during fallback will be stored by CCS-UK and forwarded to CHIEF once normal service resumes.

Finalising a Shipment or Consolidation

You should continue to finalise shipments and consolidations in the normal way during a period of fallback. This will ensure that messages associating DUCRs to the MUCR and closing the MUCR are sent as necessary. These will also be stored by CCS-UK and sent to CHIEF in the correct sequence once normal service is resumed.

Note that as a type 2 agent if you do not submit declarations during fallback then no association (of DUCR to MUCR) and close MUCR messages will be sent to CHIEF at this point or subsequently.

As arrival and departure of goods by the TSO/Airline is done at MUCR level then your declarations will not automatically update to 'departed'.

Sequoia will automatically take into account the different rules for declaration status and authorisation references when you attempt to finalise a shipment or consolidation in fallback - and will prevent you from doing so if the requirements are not satisfied.

In addition to the normal transmission of messages, a CUKG2G message will also be transmitted automatically to CCS-UK when a shipment or consolidation is successfully finalised. It is this message - and the details of consignments, declarations and authorisation references within it that is used to authorise export of the shipment when the transit shed/airline receive the goods at the frontier.

You can then arrange to move the goods to the frontier shed as normal. At this point you will not receive any notification that the goods have permission to progress - this will only happen when the goods arrive at the frontier (see below).

When goods arrive at the frontier

When goods arrive at the frontier shed they will be 'arrived' electronically by the carrier or handling agent in the normal way.

At this point the information from the CUKG2G message will be processed within CCS-UK against customs profiles and the transit shed/airline will be notified that the shipment is either 'FALLBACK HOLD' or 'FALLBACK RELEASED'.

As the Agent you will then receive a GENRAL message, detailing the action taken, as follows:

Example - MUCR A:12512345671 FALLBACK RELEASED 29 May 12 - 11:30 LHRBAC

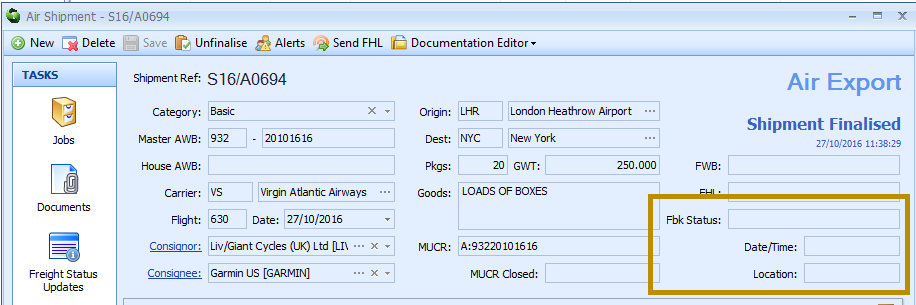

This GENRAL message will be automatically processed and the fallback status will update the Sequoia shipment form and task as indicated below.

The shipment task of each job associated to the shipment or consolidation (covered by that MUCR) will update with the details.

Recovery after fallback

When fallback is revoked, another GENRAL message will be sent by CCS-UK to all forwarders and Airline/Transit Shed systems to advise that fallback is no longer in operation. Sequoia will automatically update the fallback status flag on receipt of this message.

Declarations, associations and arrival and departure messages that have been stored by CCS-UK during fallback will then be forwarded in sequence and processed by CHIEF in the normal way. This process may take some time to finish.

This could result in a consignment that was released under fallback being subsequently selected for examination (Route 1 or 2) by CHIEF. Such anomalies will be resolved through liaison with the National Clearance Hub (NCH) until the consignment is customs cleared.

Once a MUCR has been given permission to proceed (P2P) then stored departure messages for that MUCR will also be forwarded to CHIEF and your declarations will update as 'Departed' in the normal way.

Note that this process could take some time until all stored messages are transmitted and processed.

Manually setting fallback mode

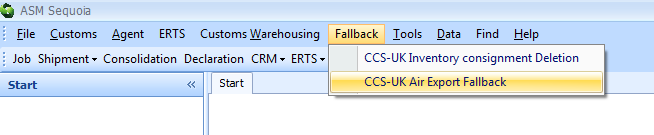

Export Fallback mode is set automatically in Sequoia on receipt of a GENRAL message from CCS-UK. There is no equivalent setting for Import Fallback mode as there are no changes to imports processing.

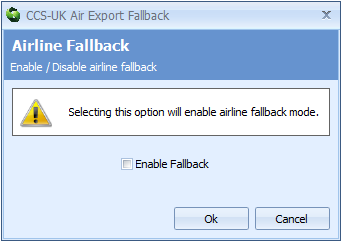

To check the current mode, or to set it or unset it manually, select the Fallback menu option on the main Sequoia menu bar (as pictured below) and select CCS-UK Air Export Fallback.

This will display the CCS-UK Air Export Fallback dialog (as shown below).

From here you can set (or unset) export fallback mode by ticking or unticking the 'Enable Fallback' box and clicking [Ok].

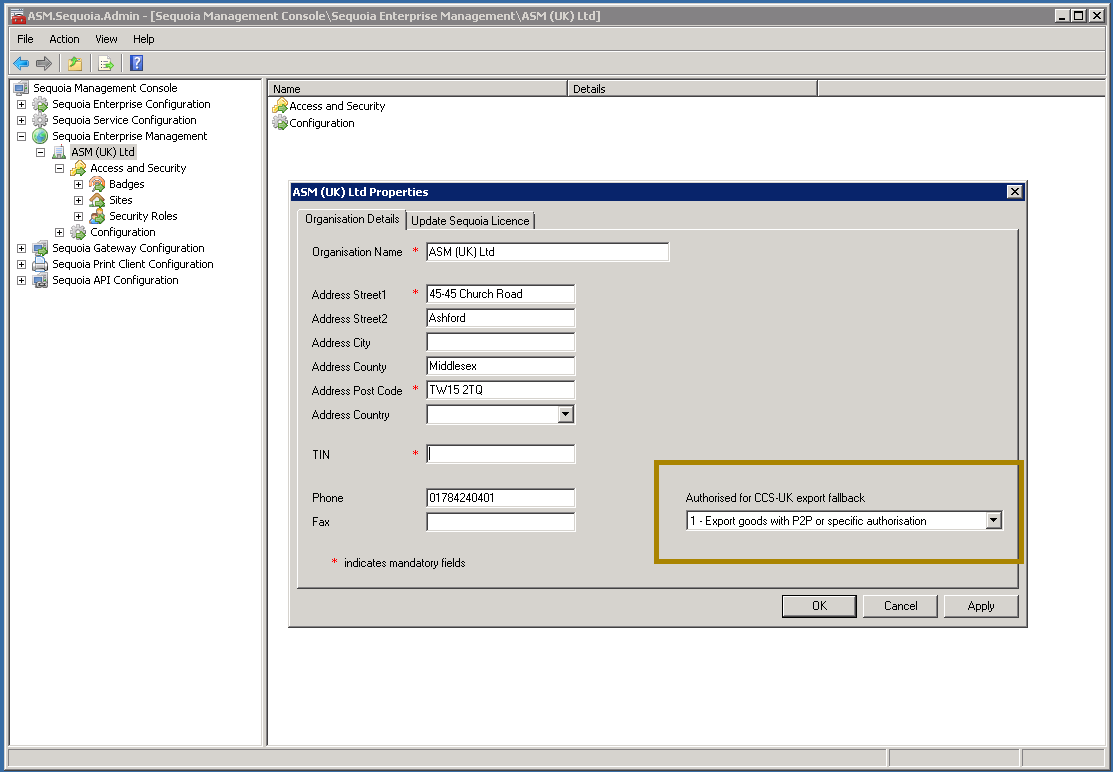

Configuration of Agent Type

The type of Agent you are, for the purposes of electronic fallback, can be configured in the Enterprise Management section of the Sequoia Configuration application (as pictured below).

This requires access to the Sequoia server. See Launch the Sequoia Configuration application for details of how to access the application.

No configuration is required for import fallback.